News

Cyclist Kate Strong Reaches Parliament Square After 3,000-Mile Ride Around Britain

Table of Contents

Introduction

When it comes to extraordinary feats of human endurance and determination, few stories can match the awe-inspiring journey of Cyclist Kate Strong. In this article, we delve deep into the remarkable adventure that saw Kate Strong cycling an astonishing 3,000 miles around Britain, culminating in her triumphant arrival at Parliament Square. Join us as we recount the inspiring tale of a woman who defied all odds, pushing the boundaries of physical and mental strength while promoting a message of sustainability and resilience.

The Journey Begins

Kate Strong’s epic cycling journey commenced on a bright summer morning, with the iconic backdrop of the White Cliffs of Dover serving as her starting point. Her mission was clear: to traverse the entire perimeter of Britain, a daunting task that would take her through a myriad of terrains, climates, and challenges.

Pedalling Through Adversity

As Kate pedalled through picturesque coastal routes and navigated the challenging hills of Scotland, her journey was not without its trials. Unpredictable weather conditions, steep inclines, and long, lonely stretches of road tested her resolve daily. However, it was her unwavering determination and unrelenting passion for the environment that kept her going.

Promoting Sustainability

One of the key motivations behind Kate Strong’s epic ride was her dedication to promoting sustainability and eco-conscious living. Along her journey, she engaged with local communities, schools, and environmental organizations, spreading the message of reducing carbon footprints and embracing greener lifestyles. Her bicycle became a symbol of change, inspiring others to take action for a better planet.

Encounters and Connections

Kate’s journey was not only a physical challenge but also a journey of the heart. She met countless individuals along the way, each with their unique stories and experiences. From the friendly locals in charming coastal villages to fellow cyclists who joined her for parts of the route, Kate’s encounters enriched her journey, creating lasting memories and connections.

Parliament Square Triumph

After months of relentless pedalling and unwavering dedication, Kate Strong reached her ultimate destination – Parliament Square in the heart of London. The iconic square, surrounded by historic landmarks and bustling with the energy of the city, served as the backdrop for an emotional and triumphant moment in Kate’s life.

Kate Strong’s Legacy

Kate Strong’s 3,000-mile journey around Britain is not merely a personal accomplishment; it is a testament to the human spirit and a call to action for a more sustainable world. Her story serves as an inspiration to all, reminding us that with determination and passion, we can overcome any obstacle and make a difference.

Conclusion

The Cyclist Kate Strong’s incredible 3,000-mile ride around Britain is a remarkable tale of resilience, dedication, and a powerful message of sustainability. Her journey captures the essence of the human spirit, showcasing what can be achieved when one person sets their mind to a monumental goal. Kate’s legacy will continue to inspire generations to come, proving that the path to change begins with a single pedal stroke.

Conflict

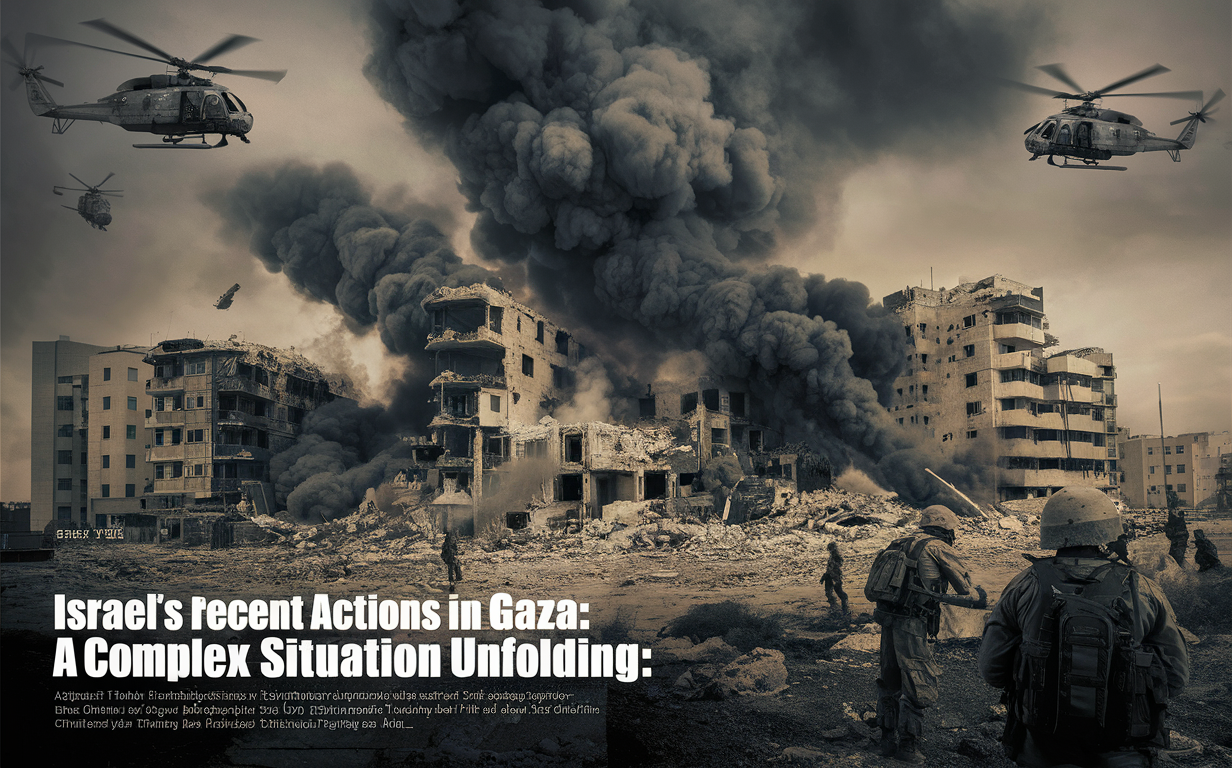

Israel’s Recent Actions in Gaza: A Complex Situation Unfolding

Israel has reopened the Kerem Shalom crossing into Gaza after its closure due to a Hamas rocket attack that resulted in the loss of four Israeli soldiers. This crossing serves as a crucial entry point for humanitarian aid. Meanwhile, the Israeli military has seized the nearby Rafah crossing between Gaza and Egypt, which remains closed. This development has raised concerns about a potential wider offensive in the region and has prompted reactions from key stakeholders like the United States. The situation is complex, and it requires a deeper understanding of the unfolding events.

Table of Contents

Kerem Shalom Crossing Reopened: A Lifeline for Humanitarian Aid

The reopening of the Kerem Shalom crossing signifies a vital step towards ensuring the flow of essential humanitarian aid into Gaza. This crossing serves as a critical lifeline for the Palestinian population, providing much-needed supplies and support in the midst of ongoing challenges. The closure following the Hamas rocket attack underscored the fragility of the situation and the immediate impact on aid delivery. By reopening this key terminal, Israel aims to address the humanitarian needs of the people in Gaza while navigating the delicate balance of security concerns.

Rafah Crossing: A Strategic Point of Contention

In contrast, the closure of the Rafah crossing, facilitated by an Israeli tank brigade’s seizure, highlights the strategic significance of this border point. The Rafah crossing, connecting Gaza to Egypt, plays a crucial role in the movement of people and goods, impacting the daily lives of Palestinians in the region. The decision to keep this crossing closed raises questions about the broader intentions behind Israel’s actions and the potential implications for the local population. As tensions simmer, the fate of Rafah remains uncertain, with implications for both security and humanitarian considerations.

Balancing Security and Humanitarian Concerns

The Israeli military’s actions in Gaza reflect a delicate balancing act between security imperatives and humanitarian considerations. The need to address security threats posed by groups like Hamas is a primary concern for Israel, given the history of conflict and violence in the region. At the same time, the humanitarian crisis in Gaza underscores the pressing need for sustained aid and support to alleviate the suffering of the local population. Navigating these dual priorities requires a nuanced approach that takes into account the complexities of the situation on the ground.

International Reactions and Diplomatic Dynamics

The looming prospect of a wider offensive in Gaza has drawn international attention, with the United States expressing concerns over the potential impact on the Palestinian population in Rafah. The delicate diplomatic dance between Israel and its allies, particularly the U.S., underscores the broader geopolitical implications of the situation. As tensions escalate, the need for diplomatic dialogue and conflict resolution mechanisms becomes increasingly urgent to prevent further escalation and mitigate the humanitarian fallout.

Looking Ahead: Pathways to Resolution

As the situation in Gaza continues to evolve, finding pathways to resolution becomes paramount. Balancing security needs with humanitarian imperatives, fostering diplomatic dialogue, and engaging with key stakeholders are essential steps towards de-escalation and long-term stability in the region. Addressing the root causes of conflict, promoting dialogue between conflicting parties, and prioritizing the well-being of the civilian population are critical components of any sustainable resolution strategy. By navigating the complexities of the situation with a focus on dialogue, cooperation, and respect for human rights, a path towards peace and stability in Gaza can be charted.

In conclusion, the recent developments in Gaza underscore the intricate web of security, humanitarian, and diplomatic challenges facing the region. By engaging in constructive dialogue, prioritizing the well-being of the civilian population, and seeking peaceful resolutions to conflict, a path towards stability and prosperity can be forged. As the situation continues to unfold, the need for concerted international efforts to address the root causes of conflict and promote lasting peace remains paramount.

Automobile

China’s Dealers Embrace Homegrown EVs, Ditching Foreign-Branded Petrol Cars

Chinese car dealers are increasingly turning towards homegrown electric vehicles (EVs), according to a report by the South China Morning Post. The trend is being driven by a combination of government incentives and changing consumer preferences. The shift towards greener vehicles is part of China’s broader efforts to reduce pollution and carbon emissions.

The report cites several examples of dealerships that have undergone makeovers to showcase China’s EV offerings. One dealership in Beijing, for instance, replaced its petrol vehicles with electric models and installed charging stations on the forecourt. Another dealership in Guangzhou has set up a separate showroom for EVs, complete with interactive displays and test-drive facilities. These initiatives not only promote China’s EVs but also offer a glimpse into the country’s broader push towards sustainable transportation.

Table of Contents

China’s Automotive Market Shift

China’s automotive market has undergone a significant shift in recent years, with a growing emphasis on electric vehicles (EVs) and a decline in the popularity of foreign petrol brands. This shift is part of the country’s broader pivot towards greener vehicles and a more sustainable future.

Transition to Electric Vehicles

China is one of the world’s largest markets for EVs, with the government offering significant support for the industry. In 2020, EV sales in China accounted for more than 40% of global EV sales, with over 1.3 million EVs sold in the country. This trend is expected to continue, with the Chinese government setting ambitious targets for EV adoption in the coming years.

To support this transition, Chinese automakers have invested heavily in EV technology and production. Many of these companies are now among the world’s largest EV manufacturers, including BYD, NIO, and Xpeng. These companies have also benefited from government subsidies and incentives, making EVs more affordable for Chinese consumers.

Decline of Foreign Petrol Brands

As China’s focus on EVs has grown, the popularity of foreign petrol brands has declined. This shift is partly due to the government’s efforts to promote domestic brands and reduce reliance on foreign imports. In addition, Chinese consumers are increasingly looking for greener and more sustainable options, leading to a decline in demand for petrol vehicles.

As a result, many foreign automakers have struggled to maintain their market share in China. Some have responded by investing in EV technology and production, while others have partnered with Chinese companies to develop new EV models. However, the dominance of Chinese automakers in the EV market means that foreign brands are likely to face significant challenges in the coming years.

Overall, China’s automotive market is undergoing a significant shift towards greener and more sustainable vehicles, with a growing emphasis on EVs and a decline in the popularity of foreign petrol brands. This shift is likely to continue in the coming years, with Chinese automakers leading the way in the development and production of EVs.

Impact on Dealerships

Adapting Showrooms

As China’s automotive market continues to shift towards electric vehicles (EVs), dealerships are having to adapt their showrooms to accommodate the changing demand. Many dealerships are now making over their showrooms to showcase homegrown EVs, while foreign-branded petrol cars are being pushed to the sidelines.

These makeovers offer an on-the-forecourt example of the country’s pivot to greener vehicles. The dealerships are investing in new technology, such as EV charging stations, to make the transition to EVs as smooth as possible for their customers.

Sales Strategy Transformation

The shift towards EVs is also requiring dealerships to transform their sales strategies. They are having to educate their sales teams on the benefits of EVs and how to sell them effectively. This includes highlighting the cost savings of EVs over petrol cars, as well as their environmental benefits.

Dealerships are also having to adjust their inventory to meet the demand for EVs. This means reducing the number of foreign-branded petrol cars in stock and increasing the number of homegrown EVs.

Overall, the impact on dealerships is significant as they adapt to the changing market. However, the investment in new technology and sales strategies is necessary to keep up with the demand for greener vehicles in China.

Government Policies and Incentives

China’s government has implemented various policies and incentives to promote the use of electric vehicles (EVs) and encourage the growth of the domestic EV industry. These policies and incentives have played a crucial role in the country’s pivot towards greener vehicles.

Subsidies for EVs

One of the most significant government policies is the provision of subsidies for EVs. The Chinese government offers purchase subsidies for buyers of new EVs, which can range from 10,000 to 50,000 yuan depending on the vehicle’s range. The subsidies are intended to make EVs more affordable for consumers and encourage the adoption of greener vehicles.

In addition to purchase subsidies, the Chinese government also provides incentives for the construction of EV charging infrastructure. Local governments are encouraged to invest in charging stations, and companies that build and operate charging stations are eligible for subsidies and tax breaks.

Regulations Favouring Domestic Brands

China’s government has also implemented regulations that favour domestic EV brands over foreign ones. For example, the government requires that a certain percentage of the vehicles sold by automakers in China must be EVs. This policy has been instrumental in promoting the growth of domestic EV brands such as BYD, Nio, and Xpeng.

Moreover, the Chinese government has also implemented a “dual credit” system that requires automakers to produce a certain number of new energy vehicles (NEVs), which include EVs and plug-in hybrids. Automakers that fail to meet the NEV production targets are required to purchase NEV credits from other automakers that have exceeded their targets. This policy has encouraged automakers to invest in the development and production of EVs and other NEVs.

Overall, China’s government policies and incentives have played a crucial role in promoting the adoption of EVs and the growth of the domestic EV industry. These policies have created a favourable environment for the development and production of greener vehicles, which is aligned with the country’s goal of reducing its carbon footprint and promoting sustainable development.

Consumer Behaviour and Preferences

Growing Environmental Awareness

China’s consumers are becoming increasingly environmentally conscious, and this is reflected in their purchasing decisions. As awareness of the impact of fossil fuels on the environment grows, more and more consumers are choosing to buy greener vehicles, such as electric cars. According to a report by McKinsey, China is expected to account for more than 50% of global electric vehicle sales by 2030.

Brand Loyalty Shifts

Another factor driving the shift towards homegrown EVs is changing brand loyalty among Chinese consumers. In the past, foreign-branded petrol cars were seen as a status symbol, and many consumers were willing to pay a premium for these vehicles. However, as Chinese automakers have improved the quality and performance of their EVs, consumers are increasingly willing to consider homegrown brands.

This shift in brand loyalty is reflected in the changing fortunes of foreign automakers in China. According to a report by the China Association of Automobile Manufacturers, sales of foreign-branded vehicles in China fell by 1.1% in 2020, while sales of domestic brands increased by 4.4%. This trend is expected to continue as Chinese automakers continue to invest in the development of new EV models.

Overall, the growing environmental awareness and changing brand loyalty among Chinese consumers are driving the shift towards homegrown EVs. As China continues to pivot towards greener vehicles, it is likely that we will see more and more consumers choosing to buy electric cars over petrol vehicles.

Future Outlook for EV Market

Predicted Market Growth

The future for the electric vehicle (EV) market in China looks bright. As the country continues to push for greener transportation, the demand for EVs is expected to rise. According to a report by BloombergNEF, China is predicted to account for over half of all EV sales globally by 2025. This growth is driven by government policies, incentives, and a growing middle class.

The Chinese government has set a target of having 20% of all new car sales to be electric by 2025. To achieve this goal, the government has implemented various policies, such as subsidies for EV buyers and stricter emission standards for traditional vehicles. These policies have helped to make EVs more affordable and attractive to consumers.

In addition, the growing middle class in China is also driving demand for EVs. As incomes rise, more people are looking for ways to reduce their carbon footprint and show their social status. EVs offer a way to do both.

Technological Advancements

As the demand for EVs grows, so does the need for technological advancements. In recent years, Chinese automakers have made significant progress in developing their own EV technology. Companies such as BYD, NIO, and Xpeng are leading the charge in developing high-quality, affordable EVs.

In addition, China is also investing heavily in battery technology. The country is home to some of the world’s largest battery manufacturers, such as CATL and BYD. These companies are working to develop better, more efficient batteries that can power EVs for longer distances.

Overall, the future for the EV market in China looks promising. With government support, growing demand, and technological advancements, the country is well-positioned to lead the way in the transition to greener transportation.

Analysis

Pandemic Winners Suffer $1.5tn Fall (Stock Market Decline) as Lockdown Trends Fade

Since the start of the pandemic, the world has seen a dramatic shift in the way people live their daily lives, affecting everything from social interactions to global economies. While some industries have thrived in the pandemic era, others have suffered significant losses. The stock market has been no exception, with some of the biggest gainers of 2020 experiencing a painful decrease in market value since the end of the year.

According to recent reports, the top 50 stock gainers of the pandemic era have suffered a $1.5tn fall in market value since the end of 2020. This decrease comes as lockdown trends begin to fade and the world looks towards a post-pandemic future. While some companies have managed to maintain their success, others have struggled to adapt to the changing landscape.

The pandemic has created winners and losers across various industries, with the stock market being no different. As the world continues to navigate through the pandemic and its aftermath, it remains to be seen which companies will emerge as the true winners and which will continue to suffer losses.

Table of Contents

Market Value Decline of Pandemic-Era Winners

Since the end of 2020, the top 50 biggest stock gainers of the pandemic era have suffered a painful decrease in market value, amounting to $1.5tn. This decline comes as lockdown trends fade and the world starts to return to some sense of normalcy.

Factors Contributing to the $1.5tn Fall

There are several factors that have contributed to the significant decline in market value of these pandemic-era winners. One of the main factors is the shift in consumer behaviour as people start to venture out and spend less time at home. This has led to a decrease in demand for products and services that were popular during the pandemic, such as home exercise equipment and online shopping.

Another factor is the increase in competition as more companies enter the market. Many businesses pivoted during the pandemic to adapt to the changing landscape, and some of these businesses have continued to thrive even as the pandemic has receded. This has led to increased competition for the pandemic-era winners, which has put downward pressure on their market value.

Comparison with Previous Market Trends

The decline in market value of pandemic-era winners is not unprecedented. Similar trends have been observed in the past when companies that experienced a surge in demand during a particular period of time saw a decline in their market value once the demand faded. For example, after the dot-com bubble burst in the early 2000s, many technology companies saw a significant decline in their market value.

However, the decline in market value of pandemic-era winners has been more pronounced due to the scale of the pandemic and the fact that it affected almost every aspect of people’s lives. As such, the decline in market value is likely to be felt for some time to come as companies continue to adjust to the new normal.

Top 50 Stock Gainers Analysis

Performance Overview

The pandemic has brought about a significant shift in the stock market, with some companies experiencing unprecedented growth. However, since the end of 2020, the top 50 biggest stock gainers have suffered a $1.5tn fall in market value. This decrease can be attributed to the fading of lockdown trends and the reopening of the economy.

The stock market is always subject to fluctuations, and the pandemic has brought about a unique set of challenges. The top 50 stock gainers have seen a decrease in their market value, but it is important to note that they still remain profitable. The decrease in market value is a reflection of the changing market conditions and does not necessarily indicate a lack of potential for future growth.

Sector-Specific Impacts

The pandemic has had a significant impact on various sectors, and this is reflected in the performance of the top 50 stock gainers. The technology sector, which saw a surge in demand due to remote work and online shopping, has been hit the hardest by the decrease in market value. Companies such as Zoom and Peloton have seen a significant decrease in their stock value.

On the other hand, companies in the healthcare and pharmaceutical sectors have seen a steady increase in their stock value. The pandemic has highlighted the importance of these sectors, and investors have responded accordingly. Companies such as Moderna and Novavax have seen a significant increase in their stock value.

Overall, the decrease in market value of the top 50 stock gainers is a reflection of the changing market conditions. While some sectors have been hit harder than others, it is important to note that the companies still remain profitable and have the potential for future growth.

Shift in Investment Patterns

Since the end of 2020, the top 50 biggest stock gainers have suffered a painful decrease in market value due to the fading of lockdown trends. The pandemic-era winners have been hit hard, with a staggering $1.5tn fall in market value.

Investors are now shifting their focus from lockdown beneficiaries to new opportunities. Companies that have thrived during the pandemic are now seeing a decline in demand as economies reopen. As a result, investors are looking for new sectors and industries that are likely to benefit from the post-pandemic world.

From Lockdown Beneficiaries to New Opportunities

Investment patterns have changed dramatically since the start of the pandemic. Companies that provided essential goods and services during lockdowns, such as online retailers, streaming services, and healthcare providers, saw a surge in demand and stock prices. However, as economies reopen, these companies are struggling to maintain the same level of growth.

Investors are now focusing on new opportunities, such as renewable energy, electric vehicles, and cybersecurity. These sectors are expected to benefit from the post-pandemic world, as governments around the world invest in infrastructure and technology to drive economic growth.

In conclusion, the pandemic has caused a significant shift in investment patterns. While the pandemic-era winners have suffered a significant decrease in market value, new opportunities are emerging for investors who are willing to adapt to the changing landscape.

Future Outlook for Pandemic-Era Stocks

Analyst Predictions

The pandemic has created a significant impact on the global economy, and the stock market was not immune to it. As lockdown trends fade, the top 50 biggest stock gainers have suffered a $1.5tn fall in market value since the end of 2020. Analysts predict that the pandemic-era stocks will continue to face challenges in the short term, but the long-term outlook for these companies remains positive.

According to a report by Goldman Sachs, technology and healthcare sectors are expected to continue to perform well in the coming years. However, companies in the travel and leisure industry may face more challenges as people remain cautious about traveling and attending large events.

Potential for Recovery

Despite the current challenges, there is still potential for recovery for pandemic-era stocks. Companies that have adapted to the changing environment and have invested in digital transformation are likely to see growth in the long term. For example, e-commerce companies have seen a significant increase in demand during the pandemic, and this trend is expected to continue in the future.

Moreover, the pandemic has accelerated the adoption of new technologies such as cloud computing, artificial intelligence, and automation. Companies that have invested in these technologies are likely to see significant growth in the coming years.

In conclusion, while pandemic-era stocks have suffered a significant decrease in market value, there is still potential for recovery in the long term. Companies that have adapted to the changing environment and invested in digital transformation are likely to see growth, while those in the travel and leisure industry may face more challenges.

Implications for Investors and Markets

The $1.5tn fall in market value of the top 50 biggest stock gainers since the end of 2020 is a clear indication that the pandemic-era winners are now suffering. This decrease is a result of the fading lockdown trends as people are starting to return to their pre-pandemic lifestyles.

Investors should take note of this trend and consider diversifying their portfolios to mitigate the risks associated with investing in pandemic-era winners. It is important to keep in mind that the pandemic has created a unique situation that is unlikely to be repeated. Therefore, investors should be cautious when investing in companies that benefited from the pandemic and consider the long-term prospects of the company before making any investment decisions.

The decrease in market value of these top 50 biggest stock gainers also has implications for the wider market. As these companies were some of the biggest winners during the pandemic, their decline could signal a shift in investor sentiment towards companies that are likely to benefit from the post-pandemic world. This could lead to a shift in investment towards companies that are more traditional and less reliant on the pandemic trends.

In conclusion, the fall in market value of the pandemic-era winners has important implications for investors and the wider market. Investors should be cautious when investing in these companies and consider the long-term prospects of the company before making any investment decisions. The decline of these companies could also signal a shift in investor sentiment towards more traditional companies.

-

Featured3 years ago

Featured3 years agoThe Right-Wing Politics in United States & The Capitol Hill Mayhem

-

Elections 20242 months ago

Elections 20242 months agoAnalyzing Trump’s Super Tuesday Triumph and Nikki Haley’s Strategic Moves

-

News2 years ago

News2 years agoPrioritizing health & education most effective way to improve socio-economic status: President

-

China3 years ago

China3 years agoCoronavirus Pandemic and Global Response

-

Canada3 years ago

Canada3 years agoSocio-Economic Implications of Canadian Border Closure With U.S

-

Conflict3 years ago

Conflict3 years agoKashmir Lockdown, UNGA & Thereafter

-

Democracy3 years ago

Democracy3 years agoMissing You! SPSC

-

Democracy3 years ago

Democracy3 years agoPresident Dr Arif Alvi Confers Civil Awards on Independence Day