Analysis

The Chip War: A Patriotic Battle for China’s Technological Sovereignty

Table of Contents

Introduction

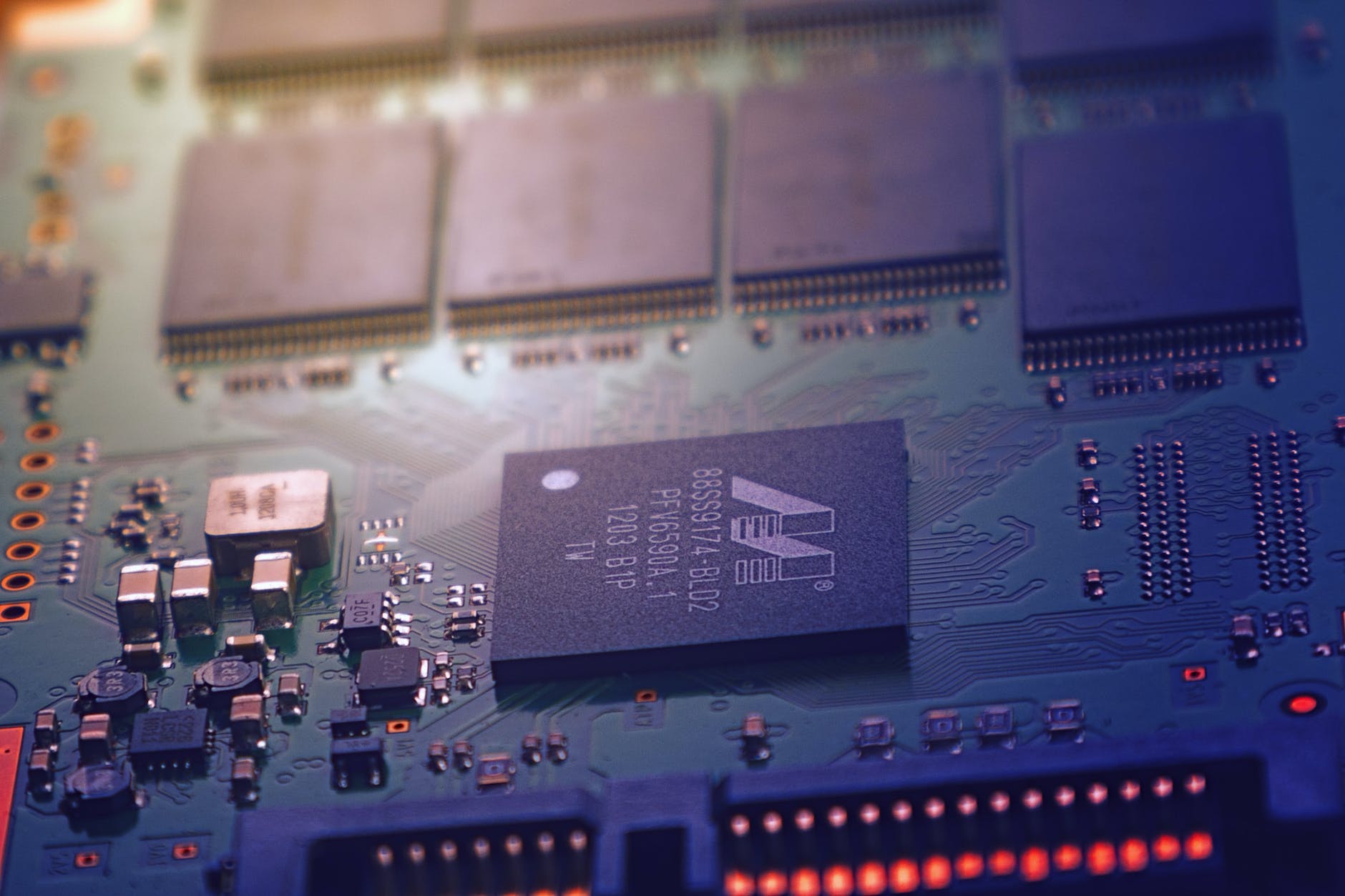

In recent times, the global landscape has witnessed a seismic shift in the dynamics of the semiconductor industry. As technological advancements continue to reshape the world, the competition for dominance in the chip manufacturing arena has intensified. China, with its rapidly growing technological prowess and ambitious initiatives like “Made in China 2025,” has emerged as a formidable player in the global semiconductor market. This has ignited what some experts are referring to as the “chip war,” characterized by fierce economic competition and a patriotic battle for technological sovereignty. The stakes are high, as countries strive to secure their positions in the lucrative world of chips, impacting not only economies but also national security and global technological advancement.

Understanding the Chip War

The chip war refers to the intense competition among nations to lead the development and production of advanced semiconductor chips. These tiny devices form the backbone of modern electronics and are crucial for advancements in various industries, including telecommunications, artificial intelligence, and autonomous vehicles.

Historically, the United States has been at the forefront of semiconductor innovation, with companies like Intel, AMD, and Qualcomm dominating the market. However, in recent years, China’s rise as a global technological powerhouse has challenged this status quo.

China’s Quest for Technological Sovereignty

China, under its “Made in China 2025” initiative, aimed to reduce its reliance on foreign technology and become self-sufficient in several strategic industries, including semiconductors. The goal is to achieve technological sovereignty and reduce vulnerability to external factors that could hinder national development.

Due to concerns over national security and intellectual property protection, the United States and other countries implemented restrictions and sanctions on Chinese technology companies, including Huawei and ZTE. These actions fueled China’s determination to break free from foreign dependencies and sparked the patriotic sentiment to develop its own chip industry.

Investment in Research and Development

To achieve its ambitious goals, China has increased investments in research and development (R&D) initiatives, specifically targeting the semiconductor sector. The government has allocated significant funds to support the establishment of new foundries, research institutes, and academic programs.

China’s strategic plan has also entailed attracting top-tier talent from around the world, providing incentives to Chinese scientists and engineers working overseas to return home and contribute to the flourishing chip industry.

Technological Advancements and Challenges

China’s progress in the chip industry has been remarkable, with its homegrown companies, such as SMIC (Semiconductor Manufacturing International Corporation) and Tsinghua Unigroup, making substantial strides. China has successfully developed its cutting-edge chips, ranging from advanced memory devices to processors.

However, the path to technological independence is not without challenges. Building a globally competitive semiconductor industry requires expertise, time, and considerable financial investments. Companies in China still face significant obstacles, such as acquiring advanced manufacturing technologies and ensuring the availability of essential intellectual properties.

The Patriotism Factor

The chip war in China has taken on a greater dimension – a patriotic battle for technological sovereignty. The collective mindset of the Chinese people has been galvanized around the notion that self-reliance in semiconductor technology is crucial for China’s economic and national security. This sentiment has further accelerated the momentum of China’s chip industry development.

Global Implications

The chip war has brought global attention to the interplay between economics, technology, and national security. The intensifying competition between the United States, China, and other countries has prompted a reevaluation of supply chain dependencies and national strategies concerning critical technologies.

The outcome of this chip war will undoubtedly have profound implications for the future of the global technology landscape. It remains to be seen whether China can achieve its goal of technological sovereignty and establish itself as a dominant force in the semiconductor industry.

Conclusion

What started as a battle for market dominance in semiconductors has transformed into a patriotic war for China’s technological sovereignty. China’s pursuit of self-reliance in the chip industry has ignited a sense of national pride and fueled ambitious goals to secure its position in the global technology race. Whether China can successfully navigate the challenges and achieve its objectives will shape the future of not only the Chinese economy but also the global technological landscape as a whole.

Note: This article provides an objective overview of the topic and does not endorse or promote any specific political agenda or viewpoint.

Analysis

Russian Finance Flows Slump After US Targets Putin’s War Machine: Washington’s Crackdown Shows Leverage Over Global Banking System

Russian finance flows have slumped after the US targeted President Vladimir Putin’s war machine. Washington’s crackdown on Russia’s military aggression has shown its leverage over the global banking system. The US has been able to use its influence over the international financial system to isolate Russia and disrupt its economic growth.

The US government has been targeting Russian banks and financial institutions that are linked to Putin’s war machine. This has led to a significant reduction in the amount of money flowing into Russia’s economy. The US has also been able to persuade other countries to impose sanctions on Russia, which has further contributed to the decline in Russian finance flows. The US has shown that it has the power to influence the global financial system and that it is willing to use this power to achieve its foreign policy objectives.

Table of Contents

Overview of US Sanctions on Russian Finance

In recent years, the United States has implemented a series of sanctions on Russian finance as part of its efforts to pressure the Russian government. These sanctions have had a significant impact on the Russian economy, particularly on Putin’s war machine and the global banking system.

Impact on Putin’s War Machine

The US sanctions have targeted key Russian individuals and entities involved in the country’s military and intelligence operations. This has resulted in a significant reduction in the flow of funds to Putin’s war machine, which has been forced to cut back on its activities and reduce its military presence in certain regions.

The impact of these sanctions has been particularly felt in Syria, where Russia has been supporting the Assad regime. With reduced funds, Russia has been forced to scale back its military operations in the country, making it more difficult for the Assad regime to maintain control.

Global Banking System Leverage

One of the key ways in which the United States has been able to implement these sanctions is through its leverage over the global banking system. As a result of the US dollar’s status as the world’s reserve currency, the majority of international transactions are conducted in dollars and pass through US banks.

This has allowed the US government to use its influence over these banks to enforce its sanctions on Russian finance. Banks that violate these sanctions can face significant fines and other penalties, which has made them hesitant to do business with Russian entities.

Overall, the US sanctions on Russian finance have had a significant impact on the Russian economy, particularly on Putin’s war machine and the global banking system. While there have been some efforts to circumvent these sanctions, the US government’s leverage over the global financial system has made it difficult for Russia to fully evade them.

Analysis of Russian Financial Flows

Current Trends

The US government’s recent crackdown on Russia has led to a significant slump in Russian financial flows. The sanctions imposed by the US on Russian companies and individuals have resulted in a decrease in foreign investment in Russia. This has led to a reduction in the amount of money flowing into the country, which has had a negative impact on the Russian economy.

The Russian government has responded to the sanctions by increasing its efforts to attract investment from other countries, particularly those in Asia. However, these efforts have so far been largely unsuccessful, as many investors are hesitant to invest in a country that is facing such significant economic challenges.

Comparative Financial Data

According to data from the Central Bank of Russia, the country’s financial flows have been decreasing steadily since the US sanctions were first announced. In the first quarter of 2022, the net outflow of capital from Russia amounted to $33.1 billion, which was a significant increase from the $8.1 billion that was recorded in the same period the previous year.

This decline in financial flows has had a negative impact on the Russian economy, which has been struggling with low growth and high inflation. The Russian government has taken steps to address these issues, including implementing economic reforms and increasing investment in infrastructure. However, the impact of these measures has been limited so far, and the country’s economic outlook remains uncertain.

In conclusion, the US government’s recent crackdown on Russia has had a significant impact on the country’s financial flows. While the Russian government has taken steps to address these challenges, the impact of these measures has been limited so far. As a result, the country’s economic outlook remains uncertain, and it is likely that the slump in financial flows will continue for the foreseeable future.

International Response

European Union Stance

The European Union (EU) has expressed concerns over the impact of the US sanctions on Russia’s economy. The EU has traditionally been a major trading partner with Russia, with trade between the two regions amounting to over €200 billion in 2023. The sanctions have caused a slump in Russian finance flows, which has had a knock-on effect on the EU’s economy. However, the EU has also expressed support for the US’s efforts to hold Russia accountable for its actions.

Global Economic Implications

The US’s crackdown on Russian finance flows has shown its leverage over the global banking system. This has raised concerns about the potential implications for the global economy. The sanctions have already had an impact on the price of oil, which has risen due to fears of supply disruptions. The sanctions could also lead to a slowdown in global trade, which would have a negative impact on the world economy.

Overall, the international response to the US’s sanctions on Russia has been mixed. While there are concerns about the impact on the global economy, there is also support for the US’s efforts to hold Russia accountable for its actions. The situation is likely to continue to evolve, and it remains to be seen what the long-term implications will be for the global economy.

Future Projections

Potential US Policy Adjustments

The US government’s recent crackdown on Russian financial flows has demonstrated its leverage over the global banking system. As a result, it is likely that the US will continue to use this leverage to target Russian interests and disrupt its financial stability. This could include further sanctions on Russian banks, businesses, and individuals, as well as increased scrutiny of financial transactions involving Russia.

Additionally, the US may seek to work with its allies to coordinate a multilateral approach to targeting Russian financial flows. This could involve the imposition of joint sanctions or the sharing of intelligence to identify and disrupt illicit financial activity.

Russian Financial Strategies

In response to the US crackdown, Russia is likely to adopt a range of financial strategies to mitigate the impact of sanctions and protect its financial stability. These could include diversifying its sources of funding, reducing its reliance on the US dollar as a reserve currency, and increasing its use of alternative payment systems.

Russia may also seek to strengthen its relationships with other countries, particularly those that are willing to provide financial support or investment. This could include China, which has already expressed its willingness to work with Russia to develop alternative payment systems and reduce their reliance on the US dollar.

Overall, the future of Russian finance flows remains uncertain. While the US has demonstrated its ability to disrupt these flows, Russia has shown a willingness to adopt new strategies to protect its financial stability. As such, it is likely that the financial relationship between the US and Russia will continue to be a source of tension and uncertainty in the years to come.

Expert Opinions

Economic Analysts Insights

Several economic analysts have expressed their concerns over the recent slump in Russian finance flows after the US targeted Putin’s war machine. According to Bloomberg, the sanctions have hit Russia’s sovereign debt, which has led to a sharp decline in the value of the ruble. This has resulted in a reduction in foreign investment in Russia, as investors are hesitant to invest in a country that is facing economic uncertainty.

In addition, the sanctions have also affected Russia’s ability to access the global banking system, which has made it difficult for Russian companies to conduct international transactions. This has further reduced the flow of finance into the country, which has had a negative impact on the Russian economy.

Political Analysts Views

Political analysts have also weighed in on the situation, with some suggesting that the US is using its leverage over the global banking system to exert pressure on Russia. According to The Guardian, the US has been able to use its position as the world’s largest economy to force other countries to comply with its sanctions against Russia.

Some political analysts have also suggested that the US is using the sanctions as a way to undermine Putin’s government and weaken Russia’s position on the global stage. However, others have argued that the sanctions are necessary to prevent Russia from engaging in aggressive behaviour towards its neighbours.

Overall, it is clear that the recent sanctions have had a significant impact on Russia’s economy and its ability to access the global banking system. While some analysts believe that the US is using the sanctions to exert political pressure on Russia, others argue that they are necessary to prevent further aggression from the country.

Analysis

The Impending Storm: Iran’s Concerns Over a Second Trump Presidency

Table of Contents

Introduction

As the political landscape in the United States evolves, the spectre of a second term for Donald Trump looms large, casting a shadow of uncertainty over international relations. For Iran, this potential scenario brings forth a myriad of concerns, ranging from economic shocks to heightened military tensions and the risk of widespread unrest. In this article, we delve into the reasons why Iran is apprehensive about the prospect of Donald Trump reclaiming the presidency, examining the implications for the country’s leadership amidst a backdrop of escalating regional conflicts.

Economic Implications

Iran’s economy has been significantly impacted by the Trump administration’s policies, particularly through the re-imposition of sanctions following the U.S. withdrawal from the Iran nuclear deal. A second Trump presidency could exacerbate these economic challenges, leading to further isolation and financial strain for Iran. The uncertainty surrounding future trade agreements and the potential for increased sanctions under a renewed Trump administration create a climate of instability that could have far-reaching consequences for Iran’s economy.

Military Escalation

One of the most pressing concerns for Iran is the possibility of bolder military action by the United States under a second Trump presidency. The recent tit-for-tat strikes with Israel and the looming threat of a wider conflict in the Middle East underscore the precarious nature of regional security. With Trump’s track record of aggressive foreign policy decisions, Iran faces the prospect of heightened military tensions and the risk of direct confrontation with the U.S. and its allies.

Impact on Leadership

The risks posed by a second Trump presidency extend beyond economic and military considerations to the very core of Iran’s leadership. The current regime faces the challenge of navigating a complex geopolitical landscape, where the actions of the U.S. can have profound implications for domestic stability. Increased protest movements, fueled by discontent over economic hardships and political repression, could further destabilize Iran’s leadership and exacerbate internal divisions.

Conclusion

In conclusion, the potential re-election of Donald Trump as U.S. president presents a formidable set of challenges for Iran, encompassing economic uncertainty, military escalation, and internal unrest. The implications of a second Trump presidency for Iran’s leadership are profound, requiring a strategic approach to navigate the complexities of international relations and safeguard the country’s interests. As Iran prepares for an uncertain future, the spectre of a second Trump presidency looms large, casting a shadow of apprehension over the nation’s political landscape.

Analysis

Unveiling Carvana’s Recent Insider Stock Sales: Analyzing the Impact of Ernest C. Garcia II’s $8.2 Million Transactions

Table of Contents

Introduction:

In the ever-changing world of stock markets, investors often scrutinize insider trading activities to gain insights into a company’s performance. Recently, Carvana Co. (NYSE:CVNA) has been making headlines due to significant shareholder Ernest C. Garcia II’s series of stock sales, which amounted to over $8.2 million. These transactions were executed between April 26 and April 29, 2024. As a result, many in the investment community are curious and analyzing the implications of these sales for both Carvana and investors at large. This article provides an in-depth analysis of Garcia’s stock sales and their implications.

Understanding the Transactions:

Ernest C. Garcia II’s stock sales unfolded over a span of four days, involving the disposal of Class A Common Stock at prices ranging from $80.0928 to $87.8791. On April 26, Garcia initiated the sales by offloading 50,000 shares at an average price of $80.0928. The subsequent transactions on April 29 comprised 6,204 shares at $83.8822, 22,246 shares at $84.9145, 14,537 shares at $85.9585, 5,764 shares at $86.7816, and 1,249 shares at $87.8791. Despite these sales, Garcia retains a significant stake in Carvana, with direct ownership of 3,212,500 shares and additional indirect holdings through trusts and LLCs.

The Regulatory Framework:

It is crucial to note that these sales were executed under a Rule 10b5-1 trading plan, established by Garcia and his spouse on March 11, 2024. This plan enables company insiders to predetermine stock trading activities at times when they are not privy to material non-public information, safeguarding against allegations of insider trading. By adhering to this regulatory framework, Garcia ensures transparency and compliance in his stock transactions.

Analyzing Garcia’s Position at Carvana:

Ernest C. Garcia II holds a prominent position at Carvana as a ten percent owner, underscoring his significant influence within the company. Despite the recent stock sales, Garcia’s substantial ownership reaffirms his vested interest in Carvana’s success and long-term growth. His continued involvement and stake in the company signal confidence in Carvana’s strategic direction and potential for future prosperity.

Investor Insights and Market Impact:

For investors and market observers, insider transactions serve as a valuable source of information regarding a company’s health and future performance. Carvana, operating in the auto retail and gasoline stations sector, has witnessed fluctuations in its stock performance, making Garcia’s transactions a focal point for shareholders and potential investors. By scrutinizing these sales, stakeholders can glean insights into Carvana’s internal dynamics, strategic decisions, and overall market positioning.

Conclusion:

In conclusion, Ernest C. Garcia II’s recent insider stock sales at Carvana have stirred interest and speculation within the investment community. By conducting these transactions under a Rule 10b5-1 trading plan, Garcia upholds regulatory compliance and transparency in his dealings. His continued ownership stake underscores his commitment to Carvana’s success and future prospects. As investors analyze these transactions for cues on the company’s trajectory, the impact of Garcia’s sales on Carvana’s stock performance and market perception remains a subject of ongoing scrutiny and evaluation.

-

Featured3 years ago

Featured3 years agoThe Right-Wing Politics in United States & The Capitol Hill Mayhem

-

Elections 20242 months ago

Elections 20242 months agoAnalyzing Trump’s Super Tuesday Triumph and Nikki Haley’s Strategic Moves

-

News2 years ago

News2 years agoPrioritizing health & education most effective way to improve socio-economic status: President

-

China3 years ago

China3 years agoCoronavirus Pandemic and Global Response

-

Canada3 years ago

Canada3 years agoSocio-Economic Implications of Canadian Border Closure With U.S

-

Conflict3 years ago

Conflict3 years agoKashmir Lockdown, UNGA & Thereafter

-

Democracy3 years ago

Democracy3 years agoMissing You! SPSC

-

Democracy3 years ago

Democracy3 years agoPresident Dr Arif Alvi Confers Civil Awards on Independence Day