Digital

Fintech NayaPay Secures $13M As It Rolls Out Digital Payments In Pakistan

NayaPay, a Pakistan-based fintech platform, has raised $13 million in one of the largest seed rounds in South Asia. Bringing together a diverse mix of leading global institutional and angel investors, the round was led by Zayn Capital, global fund manager MSA Novo and early-stage VC Graph Ventures from Silicon Valley.

Singapore-based Saison Capital, Waleed Saigol’s Maple Leaf Capital, and Warren Hogarth, CEO Empower Finance, also participated in the round, alongside a major investment from the sponsors of the Lakson Group – a Pakistani conglomerate with interests in media, telecom, industrials, financial services as well as controlling stake in Colgate-Palmolive Pakistan and McDonald’s Pakistan.

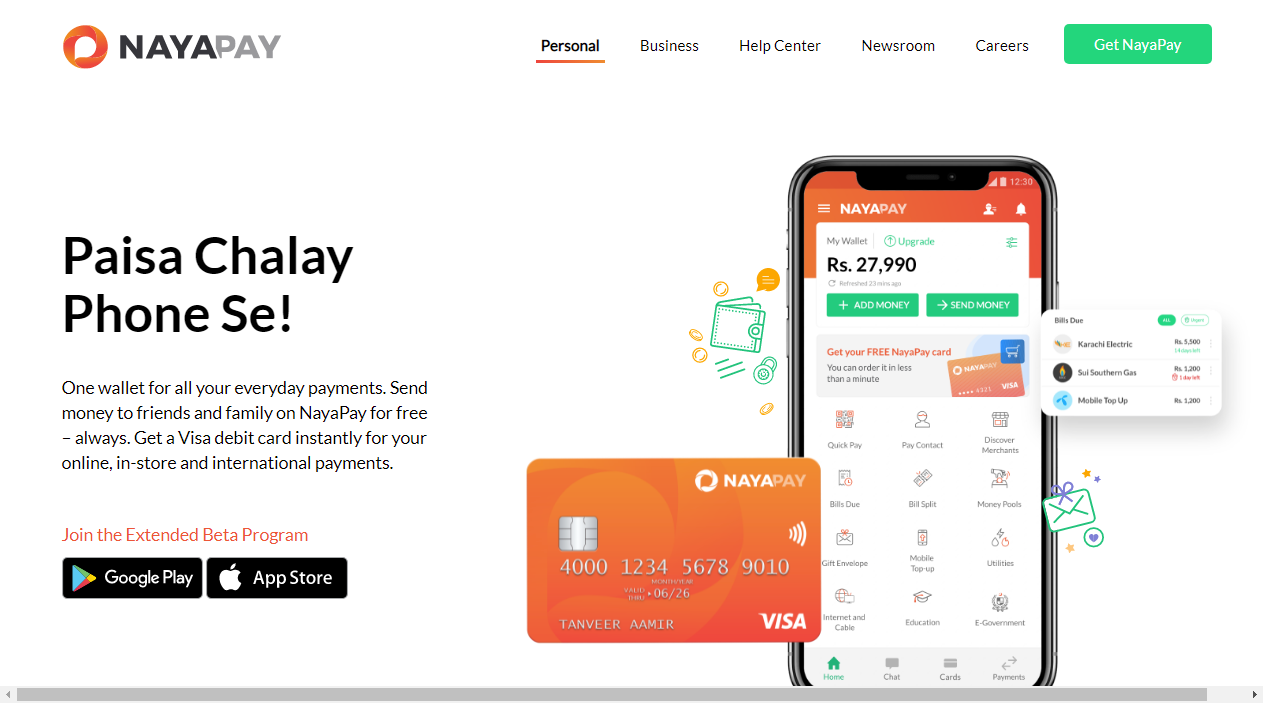

NayaPay is the first fintech of its kind in Pakistan having recently secured the first E-Money Institution license from the central bank, State Bank of Pakistan. It is on a mission to make financial services simpler and accessible to millions of Pakistani users. NayaPay aims to be at the forefront in the digitization of Pakistan with its two-sided platform for the underbanked.

Pakistan presents a significant market opportunity for NayaPay, where over 50 million adults are unbanked and only 33% of women have a bank account. With 70% of the population under 35 years old, there is a significant mobile-first generation.

Almost $4tn payments are made each year but only 1% of these are made digitally currently. On the merchant side, the majority of SMBs in Pakistan are unregistered, have traditionally dealt primarily in cash, and have very limited access to business banking.

The fintech has launched its chat-led super app targeted primarily at students and freelancers, and is building a SaaS-based platform called NayaPay Arc offering universal payment acceptance and financial management tools for SMBs.

NayaPay’s platform strategy will harness the network effects between consumers and merchants, as seen in platforms such as Square Cash/Square, WeChat Pay, AliPay, and Venmo in their native markets.

NayaPay CEO and Founder, Danish A. Lakhani, commented, “NayaPay is empowering young Pakistani adults starting their financial journey, from students stepping into adulthood to freelancers and entrepreneurs taking an active role in managing their finances. In many senses, it’s a coming-of-age moment for many and our goal is to continue to innovate and build functionality to become a part of their daily lives, for the rest of their lives.”

Danish A. Lakhani added, “Micro, small and medium businesses make up 90% of the merchant base in Pakistan, and yet they are underserved when it comes to access to basic financial services. NayaPay Arc will provide universal payments acceptance and a range of business financial management tools to empower entrepreneurs and small business owners.”

“The tools are intended to give business owners visibility of their cash flows, pay suppliers and grow sales. Our goal is to enable them to focus on growth while we take care of the rest. By helping small businesses harness the power of technology, we believe we can transform the Pakistani economy,” he added.

Faisal Aftab, Managing Partner and Co-Founder at Zayn Capital Frontier, said, “We are very bullish on fintech in Pakistan. While just beginning to emerge, Pakistani fintechs have the advantage of learning from peers and placing better informed strategic bets.”

“We were impressed by the completeness of the vision of the founding team at NayaPay, and their differentiated platform-based strategy — first focused on servicing the needs of underbanked consumers and SMBs with specific use cases and building out from there. With a proven ability to execute on the ground, the founder has an impressive track record of building and scaling businesses in Pakistan, including the country’s largest fiber broadband service (StormFiber),” he added.ADVERTISEMENT

Omar Siddiqui, General Partner at Graph Ventures, added, “We are excited to partner with Danish and the NayaPay team as they scale their leading digital payments platform for consumers and merchants in Pakistan. We have been early-stage investors in 300+ companies over the past decade in the United States, Southeast Asia, and Latin America, and we are excited to see the mobile and fintech technology trends that have empowered consumers in these markets also emerge in Pakistan.”

“NayaPay already offers the most robust solution for consumers to access next-generation financial conveniences in Pakistan, and we look forward to working with the team as they roll out new products and grow their consumer base,” he further said.

Danish A. Lakhani concluded: “Customer trust is a key pillar of any platform’s success. At NayaPay, we are consumed by our obsession to simplify the lives of both consumers and merchants with our app and NayaPay Arc while supporting our customers with robust and scalable technology and fanatic customer service. We are also partnering with leading banks to provide additional value and convenience to our mutual customers, eventually leading to a full digital banking experience.”

Discover more from The Monitor

Subscribe to get the latest posts sent to your email.

Digital

Sindh’s Salary Fiasco: A Digital Leap Marred by Institutional Failure

The Government of Sindh’s ambitious initiative to modernise salary disbursements through the State Bank of Pakistan’s (SBP) Micro Payment Gateway (MPG) was heralded as a transformative step toward efficiency, transparency, and reliability in public sector payments.

The MPG, a platform designed for high-volume, real-time disbursements, promised to streamline the process of paying government employees, replacing outdated manual systems with a digital framework that could ensure timely and accurate salary credits. The successful implementation of this system in Punjab just months ago showcased its potential, offering a glimpse of a future where bureaucratic inefficiencies would no longer hold back progress. Yet, in Sindh, what was envisioned as a leap into the future has instead descended into a chaotic nightmare, exposing deep-seated institutional failures and a troubling lack of empathy for the very employees the system was meant to serve.

As August draws to a close, thousands of government employees across Sindh find themselves caught in a distressing limbo, their salaries delayed or missing entirely. While a fortunate few with accounts at designated banks like the National Bank of Pakistan (NBP) and Allied Bank Limited (ABL) received their salaries on August 25 and 26, the vast majority remain unpaid, with no clear timeline for resolution.

For example, employees in District Kashmore with accounts at Habib Bank Limited (HBL) report no updates on their salary status, leaving them in financial uncertainty. This is not a minor technical glitch; it is a systemic breakdown that has plunged countless families into financial distress, forcing them to grapple with mounting bills, unpaid rent, and the looming threat of utility disconnections

The root of this crisis lies not in the technology itself but in the human and institutional frameworks tasked with its implementation. The MPG system, while sophisticated, is only as effective as the people and processes behind it. In Sindh, the rollout has been marred by a series of missteps that reveal a troubling lack of preparation and accountability.

Employees are caught in a bewildering maze, unsure whether their salaries will arrive via direct bank transfer or manual cheque. Their desperate attempts to seek clarity from District Accounts Offices or the Finance Department are met with either silence or contradictory information. Reports have surfaced that even employees with accounts at the “lucky” banks have not all been paid, pointing to potential errors in data processing or system integration. This has left public servants running from pillar to post, their trust in the government as an employer steadily eroding.

Two critical institutional failures underpin this fiasco. First, there is an alarming lack of training and competence at the District Accounts Office level. The MPG system, driven by complex APIs and real-time processing, demands a level of technical expertise that appears to be absent among many officials. The chaotic rollout suggests that staff were either inadequately trained or entirely unprepared to troubleshoot issues that inevitably arise during the adoption of a new system.

Second, and perhaps more egregious, is the absence of a dedicated support mechanism for affected employees. In an era where customer service is a cornerstone of even the most basic organizations, the Government of Sindh has left its employees stranded, with no helpline, complaint center, or clear channel for recourse. The Accountant General (AG) Sindh’s assertion that the system is in a “trial phase” and that issues will be resolved by September offers little solace to those struggling to meet their financial obligations today. Such statements, while perhaps technically accurate, underscore a profound lack of preparedness and empathy, further fueling confusion and frustration.

The human toll of this administrative failure cannot be overstated. A salary is not merely a transaction; it is the lifeline for millions of middle-class families across Sindh. For many, it represents the sole means of paying rent, covering school fees, settling utility bills, and putting food on the table. When salaries are delayed, the consequences ripple outward, creating a cascade of crises. Landlords demand overdue rent, schools withhold admit cards over unpaid fees, and utility companies threaten disconnection for unpaid bills. The emotional and financial strain on employees is immense, compounded by the selective nature of the payments, which has created a stark divide between the paid and the unpaid. This disparity fosters a deep sense of injustice and deprivation, damaging morale and eroding the trust that public servants place in their employer—the state itself.

The broader implications of this fiasco extend beyond individual hardship. The Government of Sindh’s failure to execute this digital transition effectively undermines its own credibility and raises questions about its capacity to deliver on other modernization initiatives. The MPG system, when implemented correctly, has the potential to revolutionize public sector payments, reducing delays, minimizing errors, and enhancing transparency. Punjab’s success with the same platform demonstrates that the technology is not the issue; rather, it is the institutional framework in Sindh that has faltered. If the government cannot ensure something as fundamental as timely salary payments, how can it inspire confidence in its ability to tackle more complex challenges, such as improving healthcare, education, or infrastructure?

To salvage this situation and prevent future recurrences, the Government of Sindh must act with urgency and decisiveness. The following measures are critical:

1. Establish a Dedicated Helpline: The government must immediately set up a well-publicised, 24/7 helpline to address employee queries and log complaints. This helpline should be staffed by trained personnel capable of providing clear, accurate information and escalating issues for swift resolution.

2. Invest in Comprehensive Training: All District Accounts Office staff must undergo rigorous training on the MPG system’s intricacies, including troubleshooting common issues and ensuring seamless integration with partner banks. This training should be ongoing to keep pace with system updates and technological advancements.

3. Standardise Processes with Clear Instructions: The State Bank of Pakistan must issue unambiguous guidelines to all partner banks to ensure uniformity in salary processing. Discrepancies between banks, such as those experienced by HBL account holders, must be addressed immediately to prevent further delays.

4. Verify Employee Data : The government, in collaboration with the AG’s office, must prioritize the verification of employee data, including CNIC numbers, bank account details, IBANs, and active cell numbers. Accurate data is the backbone of any digital payment system, and errors in this area are likely a significant cause of the current delays.

5. Commit to Radical Transparency: Employees deserve regular, proactive updates on the status of their salary disbursements. The government should implement a system of SMS or email notifications to keep employees informed, reducing anxiety and restoring confidence in the process.

6. Conduct a Post-Mortem Analysis: Once the immediate crisis is resolved, the government must conduct a thorough review of the MPG rollout to identify what went wrong and why. This analysis should involve input from employees, District Accounts Offices, and partner banks to ensure a comprehensive understanding of the failures and how to prevent them in the future.

The promise of digital payment systems like the MPG is undeniable. When executed well, they can eliminate inefficiencies, reduce corruption, and ensure that public servants are paid promptly and accurately. However, technology alone cannot compensate for institutional incompetence or a lack of accountability. The Government of Sindh must recognise that a delayed salary is more than an administrative oversight—it is a broken commitment to the very people who keep the province running. Public servants, from teachers to healthcare workers to administrative staff, deserve better than to be left in financial limbo due to bureaucratic failures.

Restoring confidence in the system will require more than technical fixes; it demands a fundamental shift in how the government approaches its responsibilities as an employer. Streamlining the MPG system with urgency, empathy, and clear communication is not just an administrative necessity—it is a moral imperative. The dignity and financial security of Sindh’s dedicated public servants hang in the balance, and the government must act swiftly to prove that it values their contributions. Only through decisive action and a commitment to accountability can Sindh turn this fiasco into a stepping stone toward a more reliable and equitable future for its employees.

Discover more from The Monitor

Subscribe to get the latest posts sent to your email.

Digital

Empowering Safety and Security: Motorola Solutions’ Innovative Impact in 2024

In a world where safety and security are paramount, the role of technology in enabling critical collaboration between public safety entities and enterprises cannot be overstated. Motorola Solutions, a global leader in mission-critical communication solutions, has once again been recognized for its innovative contributions. Fast Company’s prestigious list of the World’s Most Innovative Companies for 2024 includes Motorola Solutions, highlighting the company’s commitment to pushing the boundaries of safety and security technologies.

Table of Contents

Motorola Solutions: A Pioneer in Safety and Security Technologies

Motorola Solutions has a rich history of innovation dating back to its inception. With a focus on developing cutting-edge communication solutions for public safety agencies, enterprises, and other critical industries, the company has consistently been at the forefront of technological advancements. From two-way radios to advanced software solutions, Motorola Solutions has continuously evolved to meet the ever-changing needs of its customers.

Fast Company’s Recognition: A Testament to Innovation

Being named to Fast Company’s list of the World’s Most Innovative Companies is a significant achievement for Motorola Solutions. This recognition not only acknowledges the company’s past successes but also highlights its ongoing commitment to driving innovation in the safety and security sector. By enabling critical collaboration between public safety agencies and enterprises, Motorola Solutions is playing a crucial role in enhancing overall safety and security measures.

The Impact of Motorola Solutions’ Technologies

Motorola Solutions’ safety and security technologies have had a profound impact on how organizations approach critical communication and collaboration. By providing reliable and secure communication solutions, the company has helped streamline operations, improve response times, and enhance overall situational awareness. Whether it’s during emergencies, natural disasters, or day-to-day operations, Motorola Solutions’ technologies have proven to be indispensable for those tasked with ensuring public safety.

Enabling Collaboration: Bridging the Gap Between Public Safety and Enterprises

One of the key strengths of Motorola Solutions’ technologies is their ability to facilitate seamless collaboration between public safety agencies and enterprises. By breaking down communication barriers and enabling real-time information sharing, these solutions empower organizations to work together more effectively during emergencies and other critical situations. This level of collaboration is essential for creating safer and more secure environments for everyone involved.

Looking Ahead: The Future of Safety and Security

As technology continues to advance at a rapid pace, the role of companies like Motorola Solutions in shaping the future of safety and security becomes increasingly important. By staying at the forefront of innovation and embracing emerging technologies such as AI, IoT, and cloud computing, Motorola Solutions is poised to continue driving positive change in the safety and security landscape. The company’s commitment to excellence and its focus on enabling critical collaboration will undoubtedly play a significant role in shaping the future of safety and security.

Conclusion

In conclusion, Motorola Solutions’ inclusion in Fast Company’s list of the World’s Most Innovative Companies for 2024 is a testament to the company’s dedication to pushing the boundaries of safety and security technologies. By enabling critical collaboration between public safety agencies and enterprises, Motorola Solutions is not only driving innovation but also making a tangible impact on the safety and security of communities worldwide. As we look to the future, it is clear that companies like Motorola Solutions will continue to play a vital role in shaping a safer and more secure world for all.

Discover more from The Monitor

Subscribe to get the latest posts sent to your email.

Digital

Google Pixel 8 Pro: Unveiling the Enhanced Pixel Experience with the New Pixel Launcher Update in Response to Digital Markets Act

Introduction

In response to the Digital Markets Act, Google has released a major update for its Pixel phones, namely the Google Pixel 8 Pro, amid the ever-evolving world of technology and law. The user experience has been altered with this update, primarily concentrating on the home screen with the redesigned Pixel launcher. Let’s examine this clever new feature’s specifics and ramifications.

Table of Contents

Understanding the Digital Markets Act

The Digital Markets Act is a legislative initiative impacting users within the European Union. It aims to regulate large tech companies’ behaviour, including Google, to ensure fair competition and protect consumers’ interests. While currently affecting EU users, other countries like the U.S., U.K., and beyond are closely monitoring these developments for potential adoption of similar laws.

Evolution of Google Pixel Experience

Google’s Pixel phones have been known for their clean Android experience and timely updates. With each iteration, Google strives to enhance user satisfaction by introducing new features and improvements. The Pixel 8 Pro continues this tradition by refining the user interface with a focus on the home screen.

Unveiling the New Pixel Launcher

The centrepiece of this update is the Pixel launcher, which serves as the gateway to the phone’s functionalities. The new launcher offers a more intuitive and personalized experience, catering to users’ preferences and habits. From enhanced customization options to improved organization features, users can expect a seamless interaction with their device.

Key Features of the Updated Pixel Launcher

- Enhanced Personalization: Users can now customize their home screen layout, widgets, and app icons to reflect their unique style and needs.

- Smart Suggestions: The launcher intelligently predicts apps and actions based on usage patterns, streamlining daily tasks for increased efficiency.

- Improved Organization: With better categorization of apps and notifications, users can easily navigate through their digital ecosystem without clutter.

- Integration with Google Services: Seamless integration with Google’s ecosystem enhances productivity and connectivity across devices.

Implications for Users

The updated Pixel launcher not only elevates the user experience but also aligns with regulatory requirements set forth by the Digital Markets Act. By offering more control and transparency over data usage and app recommendations, Google aims to foster trust among users while complying with evolving regulatory standards.

Future Outlook

As governments worldwide observe the impact of the Digital Markets Act on tech giants like Google, discussions around similar regulations are gaining momentum. The proactive approach taken by Google in updating its Pixel phones sets a precedent for other companies to adapt to changing regulatory landscapes while prioritizing user satisfaction.

Conclusion

In conclusion, the introduction of the new Pixel launcher in the Google Pixel 8 Pro marks a significant step towards enhancing user experience and complying with regulatory frameworks like the Digital Markets Act. By embracing innovation and user-centric design, Google continues to set benchmarks in the smartphone industry while navigating complex legal landscapes with agility and foresight.

By combining technological advancements with regulatory compliance, Google paves the way for a more transparent and user-friendly digital future.

Discover more from The Monitor

Subscribe to get the latest posts sent to your email.

-

Featured5 years ago

Featured5 years agoThe Right-Wing Politics in United States & The Capitol Hill Mayhem

-

News4 years ago

News4 years agoPrioritizing health & education most effective way to improve socio-economic status: President

-

China5 years ago

China5 years agoCoronavirus Pandemic and Global Response

-

Canada5 years ago

Canada5 years agoSocio-Economic Implications of Canadian Border Closure With U.S

-

Democracy5 years ago

Democracy5 years agoMissing You! SPSC

-

Conflict5 years ago

Conflict5 years agoKashmir Lockdown, UNGA & Thereafter

-

Democracy5 years ago

Democracy5 years agoPresident Dr Arif Alvi Confers Civil Awards on Independence Day

-

Digital5 years ago

Digital5 years agoPakistan Moves Closer to Train One Million Youth with Digital Skills