China

The Coronavirus Economy

Perhaps the only thing we know for sure now is that nobody knows what is coming.

Never before have we seen the wheels of the economy grind so comprehensively to a halt. The first working day after the lockdown in Sindh saw an announcement of a Rs1.25 trillion stimulus package for the economy, which makes it the largest such package ever announced in the country’s history.

The day before, the army spokesman — Lt. Gen Iftikhar Babar — described the virus as “the most serious threat we have faced in living memory.” The same day as the stimulus was unveiled, the State Bank announced a 1.5 percentage point cut in interest rates in an extraordinary monetary policy statement that was hastily organised out of schedule.

As the fear of Covid-19 shuts down the world on a scale unprecedented in modern times, Pakistan’s economy — already reeling from a crippling recession — faces a near-existential threat. What could be the contours of the even more difficult days ahead?

Nobody in the business and industrial community can remember a time like this. Not the sanctions following the nuclear detonations of 1998, or the earthquake of 2005 or the Great Financial Crisis of 2008 or the floods of 2010 carry many lessons to help us see and prepare for what might be coming. Key centres of decision-making in the federal and provincial government have an idea of what is coming — a tsunami of critically ill people landing up in public hospitals — but there are few models or projections to help us understand how far this will go.

The public health emergency that is brewing around the country is one thing. The lockdowns and the enormous cost that they will exact is another. Of course, there is no trade-off here, in the sense that we are not choosing between protecting lives or livelihoods. The two are linked and a pandemic is harder to control once it has crossed a certain threshold. Whatever their cost, the lockdowns are necessary to ensure that this public health emergency does not turn into an outright catastrophe.

Table of Contents

THE COMING STORM

Between the lockdowns and the pandemic, where is the economy — already reeling from a recession — headed? At the epicentre of the coming storm will be the sheer number of critically ill people who will need varying levels of care, from quarantine to hospitalisation to intensive care. Though they are not making these numbers public, according to some sources within the decision-making centres, the provincial governments in Sindh and Punjab seem to be preparing to meet the needs of up to 80,000 such patients between four to eight weeks on. Whether they see this as the peak is not yet known.

Further out there will be the needs of the poor, or those who live just at or below the subsistence line in Pakistan. There are close to five million people identified in this group, whose particulars are available in the so-called National Socioeconomic Registry (NSER), which is the database that was the centre of the Benazir Income Support Programme.

After them there is the class of daily wagers. These are the mass of largely unskilled or low-skilled people who work in industry, services and agriculture, and rely on daily wages to meet their needs. Karachi industry circles estimate that up to four million daily wagers work in Karachi alone, whereas the government of Punjab is working with estimates of up to four million in the whole province. These people are most likely not part of the NSER database and do not show up in any formal sector employee or payrolls data either. These are some of the neediest people in times of lockdowns, yet they pose a big challenge when building a social protection programme for their income support needs because they are very difficult to locate.

In the stimulus package Rs50bn has been included specifically for this purpose, which is expenditure on top of what the provincial governments are already spending for the fight. Then comes the cost of income support and ration packs that have to be provided to the vulnerable sections, from the poor to the daily wagers and the unemployed. Even assuming Rs500 per day as the basic requirement for a household of 7, with 10 million deserving households, this means Rs5bn per day, or Rs150bn per month.

After them come the unemployed. These will include skilled workers, even lower management who might look like they live well (they will have an apartment and own a car), but have very little capacity to weather a few months without a paycheque.

These are some of the class of people who will also need help, to varying degrees, if the lockdowns are to persist for two months or more. If one looks only at the bottom two quintiles of our income population, there are close to 84 million people, living in 11 million households, according to some estimates. How many of these should the state have to look out for in the event of a prolonged lockdown?

Nobody knows how this ends. Will we succeed in defeating the virus, or will it simply work its way through the population and die or mutate into some less lethal form of its own accord? Will the summer temperatures impair its ability to transmit itself from one person to the next, to the point where it can no longer survive? Will a vaccine or a cure be found sooner than we think? Will cheap testing kits be developed soon enough that significantly boost our ability to fight this menace? Will there be a second, possibly third wave of infections like there was with the Spanish flu of 1918?

Nobody knows yet. But this analysis is based on the assumption that we are entering an intense and prolonged fight.

AN UNPRECEDENTED BLOW TO THE ECONOMY

If we are now in a prolonged fight, with no clear idea of how far we may have to lockdown the population to deny the virus any avenues for transmission, while we treat each infected person back to health, then the economy could end up taking a hit the likes of which it has never been called upon to take in the past. How might that work out?

Consider the question step by step.

First up is the direct cost of the treatment of the sick and protection of the frontline caregivers. In the stimulus package Rs50bn has been included specifically for this purpose, which is expenditure on top of what the provincial governments are already spending for the fight. Then comes the cost of income support and ration packs that have to be provided to the vulnerable sections, from the poor to the daily wagers and the unemployed. Even assuming Rs500 per day as the basic requirement for a household of 7, with 10 million deserving households, this means Rs5bn per day, or Rs150bn per month.

This is a lot of money, but it is still manageable for the state considering this is an emergency. The bigger challenge is developing the targeting technology to ensure that the right people are receiving these funds. At least three provinces have a team working on finding a way to do precisely this.

This may be the most urgent task before the state but it is far from the most expensive. If the total size of the stimulus package at Rs1.25 trillion is an indication, the government is gearing up for a very costly battle indeed. Costly enough to put an end altogether to the macroeconomic stabilisation that has been underway since July. The fight, it seems, will require us to spend all the fiscal buffers that have been built with so much pain and sacrifice over the past year.

Beyond the people, the state is now fielding increasingly restive voices from industry. Already reeling under crippling interest rates and collapsing demand, business enterprises that had seen their profits disappear since the adjustment began, now face the prospect of a mortal blow.

‘ESSENTIAL’ SERVICES

The biggest and most immediate impact of the lockdown is the halt in business operations. Out of 2,700 factories in Karachi SITE area — Pakistan’s largest industrial zone which accounts for almost 30 percent of the country’s exports according to the zone’s leadership — less than 50 were still operating on the first working day after the lockdown was announced. Those 50 were among the few that were considered essential services, primarily food and pharmaceuticals. All the rest were shut, with the workers sent home.

The port was still running but movement of cargo into and out of the gate was impaired because goods transporters could not be on the roads. Ships were berthed and dredging activity went on as normal. Containers were loaded and off-loaded, and customs processed Goods Declaration forms through the online system without requiring any physical presence, much to the relief of clearing agents. But labour was thin because many of them were stopped on their way to work and had a hard time explaining to the authorities that they were employees in an “essential services” industry. Trucks entering the province from upcountry were stopped at the provincial border, where a growing line waited for clearance to move, but nobody knew how to get this clearance and from whom.

How could law enforcement personnel determine which truck was carrying goods belonging to an “essential service” and which one is not? Is packaging material an “essential item”? What if it is necessary to package a food item in, such as ghee or edible oil?

The biggest and most immediate impact of the lockdown is the halt in business operations. Out of 2,700 factories in Karachi SITE area, less than 50 were still operating on the first working day after the lockdown was announced.

If the lockdowns are prolonged, the state will come under increasing pressure as more and more industries seek to have themselves declared as “essential services”. If food and pharmaceuticals are essential, then so are their vendors and suppliers of critical components and transporters. If a pharmaceutical firm needs to replace a spare part in a machine, then is transporting that spare part from one part of the country to another through a lockdown to be considered an “essential service” or not? How about manufacture or supply of that spare part?

Others will step forward saying that they may not be in the food or medicine business, but their products are essential in other ways.

All this happened on the first working day after the lockdown was announced. Soap manufacturers, for instance, demanded they should be counted under essential services since washing of hands on a regular basis was an essential part of the fight against the virus. What will people wash their hands with once the supplies of soap in the market run out?

Edible oil manufacturers found that, though they had permission to continue their operation, there was one vendor who supplied packaging material to them all, whose product was essential to their operation. Sure enough, that vendor also applied to the provincial government for permission to continue operations.

Textile exporters said they had orders in the pipeline which would be cancelled if delivery were not made, and valuable foreign exchange would be foregone for the country, so the federal government weighed in on the provincial chief minister to allow these exporters to complete their orders. Permission was granted.

But where does this loop end? Some argued that producing sheets for hospitals was an essential service. Others said supplying yarn and sizing services to a hospital bedsheet provider is an essential service. The fact is that, in a modern economy, even if it is as rudimentary as Pakistan’s, carving out some sectors for continuity of operations while shutting down others is simply not possible for a long period of time. Food can be described as an essential service and agriculture will be allowed to continue. But what about fertiliser distribution or pesticides?

DEALING WITH THE LOSSES

Another faultline will open once the question of absorbing the losses arising from the lockdowns has to be faced. Industry is already demanding support in return for their compliance with the lockdown terms, which include a provision that no lay-offs will be effected during this period. With the passage of time massive losses will accumulate in the form of deficits with the state, cash flows drying up with private business, and mounting requests for deferred payments and perhaps a moratorium on debt servicing on the banks.

These losses will trigger a contest where the three main constituents of our political economy — the state, big business and the citizenry — will vie to push the cost on to each other. Each will mobilise their narratives. The state will say “we are fighting the virus.” Industry will say “we are running our payrolls even though our plants are shut.” The exporters will add “we are bringing in valuable foreign exchange” — an argument that will ring all the louder because other inflows would have suffered and foreign debt servicing will remain in place.

There is one group that will come to this contest without a story, without a narrative of their own, and for this reason they will be vulnerable. That group is the banks. There is little to no public service function that creditors can claim they are performing, while their borrowers will loudly remind everyone that the banks made money all last year as the economy sank and manufacturers were weighed down by crippling interest payments as the State Bank hiked rates. They will point out that the banks made windfall profits even as the state and private manufacturers found their interest expenditure skyrocketing.

“You have made your money,” they will tell the banks, “even as we bled. Now it is time to give back because the country faces an emergency.” The banks will see mounting calls for deferments of debt service payments, some of which have already begun.

In the stimulus package announced by the Prime Minister on Tuesday, one of the promises was to arrange deferred debt service payments for manufacturers. It is not clear how the state intends to arrange for this, but in some measure, the contest has begun already.

CONTESTING NARRATIVES

In the months to come, this contest will escalate and the frenzied search for the resources with which to pay for the fight, as well as the expenses of carrying the people through it, will fuel a political economy that will consume increasing amounts of the state’s energy. With industry in lockdown, power consumption will fall dramatically, and as power capacity sits idle, some will wonder why the state should continue to pay capacity charges.

“Yes, it is in their contracts,” they will acknowledge. “But don’t these private power producers know that the country is faced with an emergency and needs every penny of its resources for the fight?” The stock market will continue its fall and brokers might try to mount an effort for another bailout, like they did last summer. It would be catastrophic if in the midst of this fight, the government were to acquiesce to their demand. Last summer, they acquiesced even though the state had begun its journey on a gruelling stabilisation effort that required massive sacrifice from the citizenry.

As the fight intensifies and the demand for resources rises, this contest might start to loosen some of the moorings of our financial system that have been held in place with iron bolts for decades. No government has asked for a moratorium on its domestic debt service obligations thus far, for example. But this time the government might ask for exactly that, for example, on the penalty interest charges on the circular debt or some other. The option to print money to pay its bills is always available for a government when dealing with local currency debt, but there are reasons why they might seek to shake down their creditors first before resorting to printing of money, if the need for resources intensifies.

This loosening has also already begun, with the extraordinary monetary policy statement announcing a rate cut of 1.5 percent on the first working day of the lockdown. I cannot remember the last time such an event occurred. The fact that it happened only days after the State Bank had already announced its monetary policy — in which steadfastly it refused to deviate from the orthodoxy of the textbook and did not lower interest rates even though inflation was falling, and the virus threat had already landed on Pakistan’s soil — only shows that serious arm twisting has already begun. More arms stand to be twisted because creditors’ interests are usually the first to be tossed overboard when the ship of state hits an iceberg or is attacked by pirates.

FEDERATION FAULTLINES

There is another faultline that may also get activated as this contest gets underway. This is the faultline within the state. The centre has already asked the provinces to bear some of the burden for the enhancements in the spending on BISP, whose beneficiaries will now receive an additional Rs1000 for the next four months as part of their entitlement. But the provinces are building their own social protection programmes and will seek a burden sharing with the centre themselves. Most likely they will arrive at an arrangement, since there is very little appetite for a fight among the elites who run the federal and provincial governments.

But provincial governments, that are also likely to feel the thirst for resources to wage the fight, cannot print money or seek any renegotiation with their creditors. They might seek an adjustment in the surpluses they are obliged to run under the National Finance Commission award. If so, this could end up meaning a significant renegotiation of the Fund programme, which is coming up for review in the next International Monetary Fund (IMF) board meeting in early April.

The timing is also critical in all this. If the fight peaks around mid- to late April, as the provincial governments expect, then the budget will be made in its aftermath. The aftermath is also likely to bring a severe recession, a scarred populace with no further appetite for absorbing economic pain for stabilisation, and continued requirements to spend in order to jump-start a traumatised economy.

Somewhere along this timeline, the government is likely to ask the IMF for a renegotiation of many of the terms of the programme. It will need to print money in massive quantities, break its budget deficit ceiling, slash interest rates and taxes.

It is unlikely that the Fund will simply refuse, since it will be clear from the beginning that Pakistan has no choice but to undertake these severe actions. But it is equally unlikely that Pakistan will find the resources from abroad to stabilise its economy without pain. That is unless ‘friendly countries’ like China and Saudi Arabia once again come to the rescue. Such a rescue will be required at that point, but who has the appetite, and how far they are willing to underwrite Pakistan’s return to normalcy, will remain to be discovered. A lot will hang in the balance as that question is explored.

THE DAYS AHEAD

Unless the economy sees massive supply disruptions, enough to hit food shipments, it is likely that March and April will see price deflation much faster than expected. Inflation was already on a downward and accelerating trajectory but, with industry closed and private consumption focused primarily on essential items and healthcare expenditures, prices are likely to see a sharp fall. This will create the space for sharp interest rate cuts, as well as large printing of money if necessary to pay for the continuously rising bill that the fight will present.

The IMF will need to be persuaded that these steps are necessary, and if printing of money is going to destabilise prices once again, the leadership could make the decision that they will worry about retiring that overhang once the fight is over.

Nobody in the business and industrial community can remember a time like this. Not the sanctions following the nuclear detonations of 1998, or the earthquake of 2005 or the Great Financial Crisis of 2008 or the floods of 2010 carry many lessons to help us see and prepare for what might be coming.

An extraordinary moment has now opened up. Business as usual will not work. It will take every ounce of creative energy and close coordination to wage this fight. The government has missed its chance to contain the pathogen at an early stage, when it was pouring into the country through travellers arriving from foreign lands. It failed to wage a campaign of awareness about the dangers posed by the virus and how best the citizenry could protect itself. It then failed to take decisive steps to order social distancing and lockdowns when they were most called for.

The result was the second and third tiers of the state’s leadership had to take up the fight. The provincial chief ministers, chief justices of the Sindh and Islamabad High Courts, individual MNAs, the Special Assistant to the Prime Minister on Health and others worked in their respective domains to build some sort of a bulwark against the entry and spread of the virus. But now it is here, and it has spread, and a battle on a wide front has become inevitable. This battle will take resources, and the search for these resources will define a lot of the state’s behavior through it all.

Via_Dawn.com

China

China’s Sinking Cities: The Looming Crisis of Subsidence and Rising Sea Levels

Introduction

China’s coastal cities, home to over 400 million people, are facing a dual threat of subsidence and rising sea levels, according to a recent study. The study, published in the journal Science, found that a quarter of China’s coastal land will sink below sea level within a century, putting millions of lives and trillions of dollars in infrastructure at risk.

Subsidence and Sea Level Rise

Subsidence, or the sinking of the land, is a natural process that occurs when the ground settles or compacts over time. However, in China’s coastal cities, the process is being accelerated by human activities, such as the over-extraction of groundwater and the weight of buildings.

The study, conducted by researchers from the Chinese Academy of Sciences and the University of California, Berkeley, analyzed satellite data and found that the rate of subsidence in China’s coastal cities has increased by up to 50% in the past decade. The researchers also found that the subsidence is linked to changes in groundwater levels and the weight of buildings.

At the same time, sea levels are also rising due to climate change. According to the National Oceanic and Atmospheric Administration (NOAA), sea levels have risen by about 3.3 millimetres per year over the past 25 years. In China’s coastal cities, the combination of subsidence and sea level rise is creating a crisis that is only expected to worsen in the coming decades.

Impact on Coastal Cities

The impact of subsidence and sea level rise on China’s coastal cities is already being felt. In Shanghai, the city’s iconic Bund waterfront has sunk by up to 2.6 meters over the past century, while in Tianjin, the city’s central business district has sunk by up to 2.5 meters.

The subsidence is causing a range of problems, from increased flooding to damage to buildings and infrastructure. In some areas, the subsidence has caused roads and buildings to crack, while in other areas, it has led to the flooding of entire neighbourhoods.

The cost of addressing the subsidence and sea level rise crisis in China’s coastal cities is estimated to be in the trillions of dollars. The Chinese government has already spent billions of dollars on measures such as building sea walls and pumping sand onto eroding beaches. However, these measures are only a temporary solution and do not address the root causes of the subsidence.

Expert Opinions

Experts warn that the subsidence and sea level rise crisis in China’s coastal cities is a ticking time bomb. “The situation is very serious and requires urgent action,” said Dr. Xiaojun Yin, a researcher at the Chinese Academy of Sciences and one of the authors of the study. “We need to reduce the extraction of groundwater and find ways to reduce the weight of buildings.”

Dr. Robert Nicholls, a professor of coastal engineering at the University of Southampton, agrees. “China’s coastal cities are facing a perfect storm of subsidence and sea level rise,” he said. “The Chinese government needs to take urgent action to address the root causes of the subsidence and invest in long-term solutions to protect its coastal cities.”

Conclusion

China’s coastal cities are facing a crisis of subsidence and sea level rise that is only expected to worsen in the coming decades. The crisis is being driven by human activities, such as the over-extraction of groundwater and the weight of buildings. The Chinese government needs to take urgent action to address the root causes of the subsidence and invest in long-term solutions to protect its coastal cities.

The cost of addressing the crisis is estimated to be in the trillions of dollars, but the cost of inaction is likely to be much higher. Millions of lives and trillions of dollars in infrastructure are at risk. The Chinese government must act now to prevent a catastrophic flood from engulfing its coastal cities.

China

German leader’s China trip criticised for prioritising business interests over Brussels’ de-risking agenda

German Chancellor Angela Merkel’s recent trip to China has sparked controversy and criticism. Many are unhappy with her apparent prioritisation of German business interests over supporting Brussels’ de-risking agenda. In public remarks during the trip, Merkel did not voice support for the EU’s efforts to limit economic dependence on China, instead focusing on promoting German businesses and their interests in the country.

Some have called Merkel’s approach a “disaster” and “regrettable”, arguing that it sends the wrong message to China and undermines the EU’s efforts to reduce its economic reliance on the country. Critics have accused Merkel of prioritising short-term economic gains over long-term strategic interests, and of failing to adequately address issues such as human rights abuses in China.

The controversy surrounding Merkel’s China trip highlights the complex relationship between Europe and China, and the challenges facing the EU as it seeks to balance economic interests with strategic concerns. As tensions between the US and China continue to escalate, the EU faces pressure to take a more assertive stance on issues such as trade, human rights, and security.

Table of Contents

Chancellor’s Controversial China Visit

Criticism of German Leader

German Chancellor’s recent visit to China has been met with criticism from some quarters. Critics have accused the Chancellor of prioritizing German business interests over the de-risking agenda of Brussels. In her public remarks in China, the Chancellor did not throw her support behind the European Union’s agenda of reducing risks associated with China’s Belt and Road Initiative.

The critics have argued that the Chancellor’s visit was a missed opportunity to promote the interests of the European Union. They have raised concerns that the Chancellor’s focus on German business interests could undermine the EU’s efforts to address the risks associated with China’s Belt and Road Initiative.

Focus on Business Interests

During her visit to China, the Chancellor focused primarily on promoting German business interests. She led a delegation of German business leaders to China and signed several trade agreements.

The Chancellor’s focus on business interests has been praised by some as a pragmatic approach to promoting German economic growth. However, others have criticized her for ignoring the EU’s de-risking agenda and failing to promote a united front against China’s Belt and Road Initiative.

Overall, the Chancellor’s visit to China has been a subject of controversy. While some have praised her for promoting German business interests, others have criticized her for failing to support the EU’s de-risking agenda.

EU De-Risking Agenda and German Stance

Lack of Support for Brussels

During her recent trip to China, German Chancellor Angela Merkel did not throw her support behind the European Union’s (EU) de-risking agenda. This agenda aims to reduce the EU’s dependence on China and mitigate the risks associated with economic engagement with the country. Merkel’s lack of support for this agenda has drawn criticism from some quarters.

The de-risking agenda was introduced in response to concerns about China’s human rights record, as well as its economic practices, such as the theft of intellectual property. The EU aims to reduce its dependence on China by diversifying its economic partnerships and investing in domestic industries. Merkel’s failure to endorse this agenda has raised questions about Germany’s commitment to the EU’s broader goals.

Implications for EU-China Relations

Merkel’s focus on German business interests during her trip to China has been seen as a sign of Germany’s increasing economic dependence on China. This has raised concerns about the potential implications for EU-China relations. Some experts have suggested that Merkel’s stance could undermine the EU’s efforts to present a united front on issues such as trade and human rights.

Moreover, Merkel’s failure to support the EU’s de-risking agenda could make it more difficult for the EU to negotiate with China on issues such as market access and intellectual property protection. This could have negative implications for both the EU and Germany, as China is an important market for German businesses.

In conclusion, Merkel’s lack of support for the EU’s de-risking agenda and her focus on German business interests during her recent trip to China have raised questions about Germany’s commitment to the EU’s broader goals. This could have negative implications for EU-China relations and make it more difficult for the EU to negotiate with China on key issues.

Reactions and Consequences

Domestic Response

The German Chancellor’s China trip has drawn criticism from various domestic quarters. Critics have accused the Chancellor of prioritizing German business interests over the EU’s de-risking agenda. The opposition parties have been particularly vocal in their criticism, with some accusing the Chancellor of undermining EU unity.

The SPD, the junior partner in the governing coalition, has called for an urgent debate in the Bundestag to discuss the Chancellor’s China trip. The party’s leader, Saskia Esken, has said that the Chancellor’s remarks in China are “regrettable” and that they do not reflect the EU’s position on China.

International Perspective

The Chancellor’s China trip has also raised concerns among Germany’s EU partners. Some EU officials have expressed disappointment that the Chancellor did not use her visit to throw her support behind Brussels’ de-risking agenda. They have also expressed concern that the Chancellor’s focus on German business interests could undermine the EU’s collective approach to China.

The French President, Emmanuel Macron, has been particularly critical of the Chancellor’s China trip. In a recent interview, he called on Germany to show more solidarity with its EU partners on China. He also criticized the Chancellor for not taking a tougher stance on human rights issues in China.

Overall, the Chancellor’s China trip has sparked a heated debate in Germany and the EU. While some have praised the Chancellor for promoting German business interests, others have criticized her for undermining EU unity and failing to support Brussels’ de-risking agenda.

Analysis

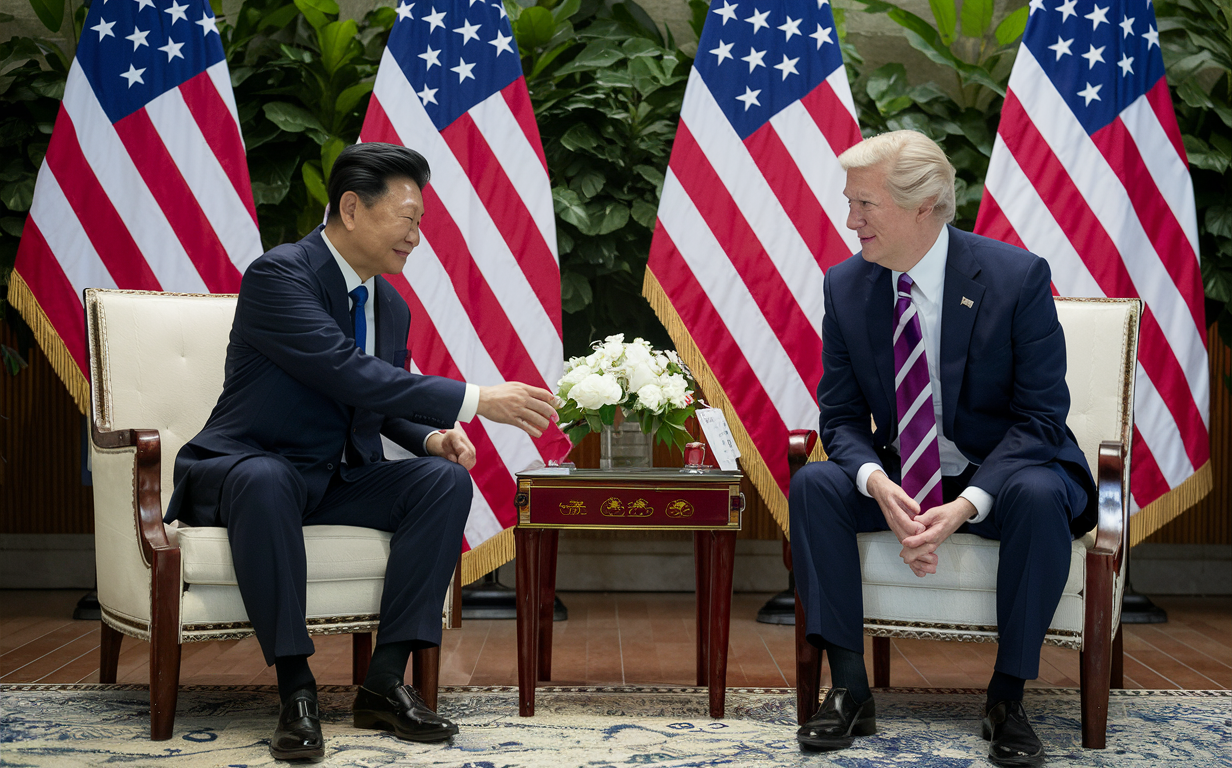

Breaking Down the Xi-Biden Phone Call: A Step Forward in China-US Relations

In a significant development, Chinese President Xi Jinping and US President Joe Biden engaged in a ‘candid’ direct conversation, marking their first call since 2022. This conversation holds immense importance as it comes at a time when tensions between the two global powers have been escalating. Let’s delve into the details of this crucial phone call and its implications for China-US relations.

Table of Contents

Understanding the Context

The backdrop against which this phone call took place is crucial to grasp the significance of the dialogue. Tensions between China and the United States have been on the rise due to various issues ranging from trade disputes to human rights concerns. The need for constructive dialogue between the two leaders has never been more pressing.

Key Points of Discussion

During the phone call, Xi and Biden reportedly discussed a range of topics, focusing on areas where their interests align. This ‘candid’ conversation indicates a willingness on both sides to engage in meaningful dialogue despite the challenges that exist in their relationship.

Progress Made and Areas of Agreement

The fact that progress was achieved in limited areas of aligned interests is a positive sign for China-US relations. This could potentially pave the way for further cooperation on issues of mutual concern such as climate change, global health, and regional security.

Implications for Global Dynamics

The outcome of this phone call has broader implications for the global geopolitical landscape. As two of the most influential countries in the world, any positive developments in China-US relations can have far-reaching effects on international trade, security, and diplomacy.

Analysis of the Tone and Approach

The use of the term ‘candid’ to describe the conversation between Xi and Biden suggests a level of openness and honesty in their exchange. This could indicate a shift towards more transparent communication between the two leaders, which is essential for building trust and resolving differences.

Future Prospects and Challenges

While the phone call signifies a step in the right direction, it is important to acknowledge the challenges that lie ahead. Both China and the US have complex issues to address, and sustaining this momentum towards improved relations will require continued effort and cooperation from both sides.

Conclusion

The recent phone call between Xi Jinping and Joe Biden marks a positive development in China-US relations. By analyzing the key points of discussion, progress made, and implications for global dynamics, we can gain valuable insights into the evolving dynamics between these two global powers. This dialogue sets the stage for future engagement and cooperation, highlighting the importance of constructive communication in navigating the complexities of international relations.

-

Featured3 years ago

Featured3 years agoThe Right-Wing Politics in United States & The Capitol Hill Mayhem

-

Elections 20242 months ago

Elections 20242 months agoAnalyzing Trump’s Super Tuesday Triumph and Nikki Haley’s Strategic Moves

-

News2 years ago

News2 years agoPrioritizing health & education most effective way to improve socio-economic status: President

-

China3 years ago

China3 years agoCoronavirus Pandemic and Global Response

-

Canada3 years ago

Canada3 years agoSocio-Economic Implications of Canadian Border Closure With U.S

-

Conflict3 years ago

Conflict3 years agoKashmir Lockdown, UNGA & Thereafter

-

Democracy3 years ago

Democracy3 years agoMissing You! SPSC

-

Democracy3 years ago

Democracy3 years agoPresident Dr Arif Alvi Confers Civil Awards on Independence Day