Analysis

Imran Khan’s graceless exit

Leaders come and go, but the manner in which Prime Minister Imran Khan was ousted from power through a parliamentary vote of no confidence has no precedent in Pakistani history.

After the opposition had mustered the necessary support of the members of the National Assembly, Khan could have resigned and exited from power with grace. Instead, he chose to cling to power until the last moment by sabotaging the vote of no confidence proceedings, despite a clear verdict from the Supreme Court to complete the voting process on Saturday. A cricket legend who played politics like a T-20 match; he kept the nation on its toes until midnight. His ego seemed bigger than the country he led.

Khan promised to build a new ‘Naya’ Pakistan, a thriving nation free from corruption beyond the dynastic politics of the past. But his nearly four years of narcissistic rule have been so nightmarish that ultimately public representatives opted to vote for Old Pakistan.

Khan leaves behind a nation with deeply polarised politics, an economy nearing collapse, and a foreign policy that has ruptured relations with major powers and trusted allies. Challenges that will be difficult to surmount by his successor, Shehbaz Sharif, the leader of Pakistan Muslim League-Nawaz.

Pakistan has a chequered political history. In the past half century, long military rules have been followed by unstable civilian eras. This instability is often the result of the military’s intrusion into politics. The current impasse is no different, except that the alternative leader the generals tried to cultivate eventually became a Frankenstein.

To be sure, the post-Musharraf transition to democracy is different from the previous two such transitions of the 70’s and 90’s in the sense that rapid urbanization in the past couple of decades has produced a middle class that is no longer apolitical. Khan’s personal charm galvanised this class, especially its youth segment, leading to the emergence of PTI as a potent challenge to mainstream political parties, including the PMLN and Pakistan People’s Party.

Instead of focusing on the economy, Khan pursued a vengeful accountability drive against the leaders of PMLN and PPP. Their character assassination by trolls on social media, with unfounded accusations of corruption and treason, has introduced a level of toxicity in politics never seen before.

Ishtiaq Ahmad

In the PTI’s rise, the military saw an opportunity to discredit both parties. Thus began the unique experiment of a regime built on the premise that civilian and military leaders would remain on the ‘same page.’ The bargain was that Khan would receive unwavering support from the military leadership and his government would, in return, deliver tangible economic outcomes through better governance. Keeping the opposition at bay was a shared interest.

But this bargain took no time to flicker due to the bad economic start of the Khan regime. It wasted almost a year in negotiating a bailout package with the IMF worth $6 billion, which devaluated the rupee. The subsequent period has seen further economic mismanagement amid the global pandemic, curtailing the GDP growth rate from 5.9% in 2018 to 3.4% this year. IMF conditionalities have led to double digit inflation. Foreign borrowing has raised the debt burden significantly. The economic corridor project with China is derailed. Unemployment has also skyrocketed. There is deep public disillusionment as a result.

Instead of focusing on the economy, Khan pursued a vengeful accountability drive against the leaders of PMLN and PPP, who were hounded and jailed on alleged corruption charges that remain unproven in any court of law. Their character assassination by trolls on social media, with unfounded accusations of corruption and treason, has introduced a level of toxicity in politics never seen before.

Islam has been a convenient tool for both military and civilian leaders to divert public attention from real socio-economic issues. But the way Khan has used his religious narrative to cultivate support among the population has no parallel.

Under no circumstances does the military allow civilian leaders to play with its chain of command, but Khan crossed this red line. He also played the American conspiracy card, using a diplomatic cable from the ex-envoy in Washington to claim the no confidence motion was a US ploy to change his regime. All his opponents, he dubbed traitors.

Without the military’s support, Khan could not have made it to the premiership. Its top brassindeed bet on the wrong horse and may have learned a hard lesson. His reckless subversion of the constitution to keep himself in power has also annoyed the judiciary and, perhaps, a significant chunk of his urban middle class supporters who have already borne the brunt of indirect taxes under PTI rule.

Despite his disgraceful exit from power, Khan retains a cult following among the youth. But with key PTI financiers drifting away and his own accountability about to begin, Khan’s political fate now hangs in the balance. The emergence of PTI as an alternative political force to cater to the rightful aspirations of the middle class was a good thing in the patronage-driven politics of Pakistan. Its demise – at the hands of its own leader – will be quite unfortunate.

Courtesy ARABNEWS

Analysis

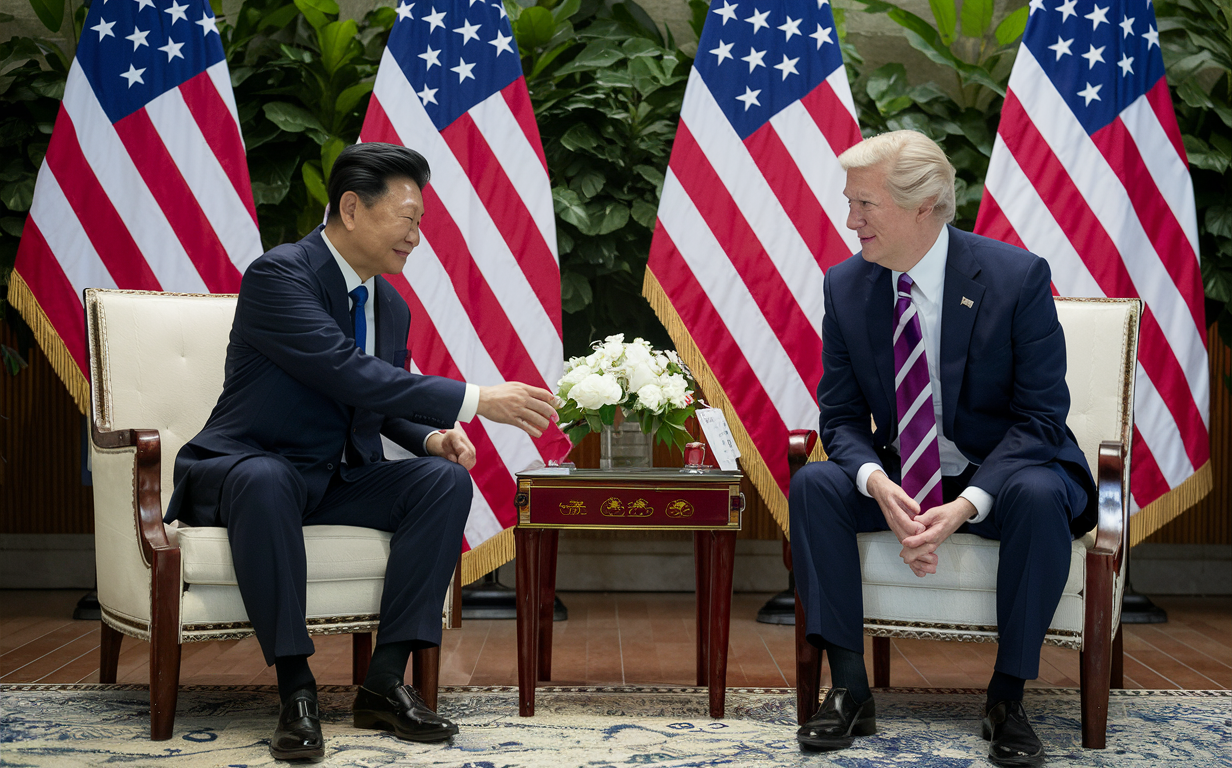

Breaking Down the Xi-Biden Phone Call: A Step Forward in China-US Relations

In a significant development, Chinese President Xi Jinping and US President Joe Biden engaged in a ‘candid’ direct conversation, marking their first call since 2022. This conversation holds immense importance as it comes at a time when tensions between the two global powers have been escalating. Let’s delve into the details of this crucial phone call and its implications for China-US relations.

Table of Contents

Understanding the Context

The backdrop against which this phone call took place is crucial to grasp the significance of the dialogue. Tensions between China and the United States have been on the rise due to various issues ranging from trade disputes to human rights concerns. The need for constructive dialogue between the two leaders has never been more pressing.

Key Points of Discussion

During the phone call, Xi and Biden reportedly discussed a range of topics, focusing on areas where their interests align. This ‘candid’ conversation indicates a willingness on both sides to engage in meaningful dialogue despite the challenges that exist in their relationship.

Progress Made and Areas of Agreement

The fact that progress was achieved in limited areas of aligned interests is a positive sign for China-US relations. This could potentially pave the way for further cooperation on issues of mutual concern such as climate change, global health, and regional security.

Implications for Global Dynamics

The outcome of this phone call has broader implications for the global geopolitical landscape. As two of the most influential countries in the world, any positive developments in China-US relations can have far-reaching effects on international trade, security, and diplomacy.

Analysis of the Tone and Approach

The use of the term ‘candid’ to describe the conversation between Xi and Biden suggests a level of openness and honesty in their exchange. This could indicate a shift towards more transparent communication between the two leaders, which is essential for building trust and resolving differences.

Future Prospects and Challenges

While the phone call signifies a step in the right direction, it is important to acknowledge the challenges that lie ahead. Both China and the US have complex issues to address, and sustaining this momentum towards improved relations will require continued effort and cooperation from both sides.

Conclusion

The recent phone call between Xi Jinping and Joe Biden marks a positive development in China-US relations. By analyzing the key points of discussion, progress made, and implications for global dynamics, we can gain valuable insights into the evolving dynamics between these two global powers. This dialogue sets the stage for future engagement and cooperation, highlighting the importance of constructive communication in navigating the complexities of international relations.

Analysis

US Trade Representative Katherine Tai Criticizes China for Filing WTO Complaint Regarding Electric Vehicle (EV) Subsidies

US Trade Representative Katherine Tai has denounced China for filing a complaint with the World Trade Organization (WTO) over electric vehicle (EV) subsidies. Tai has accused China of using “unfair, non-market policies and practices to undermine fair competition and pursue the dominance of the PRC’s manufacturers.” Beijing has objected to a US law that it says provides “discriminatory” subsidies for EVs.

Tai’s remarks come as tensions between the US and China continue to escalate, with both countries accusing each other of unfair trade practices. The US has previously accused China of stealing intellectual property and engaging in forced technology transfers, while China has accused the US of unfairly targeting its companies with sanctions and export controls.

The dispute over EV subsidies is just the latest in a series of trade disputes between the two countries, and it remains to be seen how it will be resolved. However, Tai’s strong words suggest that the US is prepared to take a tough stance against China’s trade practices, and that the dispute is unlikely to be resolved quickly or easily.

Table of Contents

US Trade Representative Katherine Tai’s Statement

Denouncement of China’s WTO Complaint

US Trade Representative Katherine Tai has denounced China for filing a complaint with the World Trade Organization (WTO) over what it calls “discriminatory” subsidies for electric vehicles in the United States. Tai stated that “China continues to use unfair, non-market policies and practices to undermine fair competition and pursue the dominance of the PRC’s manufacturers”.

Tai’s statement comes after China filed a complaint with the WTO on March 22, 2024, alleging that a US law provides “discriminatory” subsidies for electric vehicles. The law in question, the Electric Vehicle Tax Credit, provides a tax credit of up to $7,500 for the purchase of a new electric vehicle. China argues that this tax credit is only available to US-made electric vehicles, and therefore discriminates against foreign-made electric vehicles, including those made in China.

Criticism of China’s Non-Market Policies

Tai’s statement also criticized China’s non-market policies, which she says are designed to give Chinese companies an unfair advantage in the global marketplace. These policies include subsidies for domestic companies, restrictions on foreign investment, and intellectual property theft.

Tai’s denouncement of China’s WTO complaint is the latest in a series of moves by the Biden administration to confront China on trade issues. The administration has also taken steps to address China’s human rights abuses, including sanctions on Chinese officials and companies involved in the repression of Uyghur Muslims in Xinjiang province.

Overall, Tai’s statement reflects the US government’s commitment to fair competition and a level playing field for all companies, regardless of their country of origin.

China’s Objections to US EV Subsidies

Allegations of Discriminatory US Law

China has accused the US of providing “discriminatory” subsidies for electric vehicles (EVs) through a tax credit system that only applies to domestically produced vehicles. The US law in question, known as the Electric Vehicle Tax Credit, provides a tax credit of up to $7,500 for the purchase of a new EV. However, the credit is only available for EVs produced by manufacturers that have not yet sold 200,000 qualifying vehicles in the US. This has led to accusations that the law unfairly benefits US automakers, while discriminating against foreign manufacturers such as those from China.

China’s WTO Complaint Filing

China has filed a complaint with the World Trade Organization (WTO) over the US law, arguing that it violates WTO rules by providing “discriminatory subsidies” to US automakers. In response, US Trade Representative Katherine Tai has denounced China’s complaint, stating that “China continues to use unfair, non-market policies and practices to undermine fair competition and pursue the dominance of the PRC’s manufacturers.” Tai has also accused China of “continuing to use unfair trade practices to gain an unfair advantage in the global marketplace.”

The US has countered China’s complaint by arguing that the Electric Vehicle Tax Credit is not discriminatory, as it applies equally to all automakers that meet the eligibility criteria. The US has also argued that the tax credit is intended to promote the adoption of EVs in the US, and is therefore consistent with WTO rules that allow for certain types of subsidies to promote environmental protection.

Overall, the dispute between the US and China over EV subsidies highlights the ongoing tensions between the two countries over trade policy, and the challenges of balancing domestic priorities with international trade obligations.

Implications for US-China Trade Relations

The recent filing of a WTO complaint by China over US subsidies for electric vehicles has the potential to further strain the already tense trade relations between the two nations. The US Trade Representative, Katherine Tai, has denounced China’s actions, stating that they are using “unfair, non-market policies and practices to undermine fair competition and pursue the dominance of the PRC’s manufacturers”.

This latest development is not the first time that the US and China have been at odds over trade policies. The two nations have been engaged in a trade war since 2018, with each imposing tariffs on the other’s goods. The dispute has had far-reaching effects, with both nations suffering economic losses as a result.

The filing of the WTO complaint by China is likely to escalate tensions even further. The complaint alleges that a US law providing subsidies for electric vehicles is discriminatory, and violates WTO rules. The US has denied these allegations, and has stated that the subsidies are intended to promote the use of electric vehicles, and are not discriminatory in any way.

The outcome of this dispute remains to be seen, but it is clear that it will have significant implications for US-China trade relations. If the WTO rules in China’s favor, it could lead to further trade restrictions and tariffs being imposed by the US. On the other hand, if the US is successful in defending its subsidies, it could embolden the nation to continue its current trade policies, further straining relations with China.

Analysis

The US Faces a Market Shock: An Analysis of the Soaring Debt and Its Impact on the Economy

Introduction

The US economy is facing a significant challenge as the national debt continues to soar, reaching unprecedented levels. The independent Congressional Budget Office (CBO) has warned that the fiscal burden is on an ‘unprecedented’ path, echoing concerns raised by the UK’s former Chancellor, Liz Truss, who faced a similar market shock due to her government’s debt management strategies. This article aims to provide a well-researched and analytical perspective on the current state of the US economy, comparing it with other countries, and discussing potential debt management strategies.

1: The State of the US Economy

The US economy has been experiencing a period of significant growth, with the GDP expanding at an annual rate of 2.6% in the fourth quarter of 2023. However, this growth has been accompanied by a surge in the national debt, which has reached $31.4 trillion, or 126% of GDP. This is the highest debt-to-GDP ratio since the end of World War II. The CBO has projected that the debt will continue to grow, reaching $36.5 trillion by 2033.

2: Comparison with Other Countries

The US is not alone in facing a debt crisis. Many other countries, including the UK, Japan, and Italy, are also grappling with high levels of debt. However, the pace at which the US debt is growing is particularly concerning. As of 2023, the US has the highest total public debt of any country in the world. This is partly due to the large stimulus packages implemented during the COVID-19 pandemic, which have contributed to a significant increase in government spending.

3: Impact on the US Economy

The soaring debt has several potential negative impacts on the US economy. Firstly, it could lead to higher interest rates, as investors demand higher returns to compensate for the increased risk of lending to the US government. This could slow down economic growth and potentially trigger a recession. Secondly, the debt could lead to a loss of confidence in the US dollar, as investors may perceive it as a less safe investment compared to other currencies. Lastly, the debt could lead to a decline in the US’s credit rating, making it more expensive for the government to borrow money.

4: Debt Management Strategies

To mitigate the negative impacts of the soaring debt, the US government could implement several debt management strategies. These include:

- Fiscal consolidation: Reducing government spending and increasing taxes to reduce the deficit and lower the debt-to-GDP ratio.

- Structural reforms: Implementing reforms to increase economic growth and reduce the burden of the debt on future generations.

- Debt restructuring: Negotiating with creditors to restructure the debt, potentially reducing the interest rate or extending the repayment period.

- Inflation targeting: Managing inflation to ensure that the real value of the debt does not increase too rapidly.

Conclusion

The US economy is facing a significant challenge due to the soaring national debt. This debt can potentially impact the economy negatively, and the government must implement effective debt management strategies to mitigate these risks. By comparing the US situation with other countries and analyzing the potential impacts of the debt, this article provides a comprehensive perspective on the current state of the US economy.

-

Featured3 years ago

Featured3 years agoThe Right-Wing Politics in United States & The Capitol Hill Mayhem

-

Elections 20241 month ago

Elections 20241 month agoAnalyzing Trump’s Super Tuesday Triumph and Nikki Haley’s Strategic Moves

-

News2 years ago

News2 years agoPrioritizing health & education most effective way to improve socio-economic status: President

-

China3 years ago

China3 years agoCoronavirus Pandemic and Global Response

-

Canada3 years ago

Canada3 years agoSocio-Economic Implications of Canadian Border Closure With U.S

-

Conflict3 years ago

Conflict3 years agoKashmir Lockdown, UNGA & Thereafter

-

Democracy3 years ago

Democracy3 years agoMissing You! SPSC

-

Democracy3 years ago

Democracy3 years agoPresident Dr Arif Alvi Confers Civil Awards on Independence Day